Pennies for Charity

Fundraising by professional fundraisers

> Giving in New York State

> Giving wisely: How to use this report

> How dollars went to charities ─ and to professional fundraisers

> Donor-advised funds affect the giving landscape

> Online appeals engage small donors – but online giving presents new challenges

> Telemarketers target smaller donors – but are they calling for a charity?

> What lies ahead for charities and fundraisers

> Tips for donors

Giving in New York State

As New York’s chief law enforcement officer and regulator of charitable fundraising, Attorney General Letitia James works diligently to protect charities and their donors. The Charities Bureau of the Office of the New York State Attorney General (OAG) prepared this year’s Pennies for Charity report to help individual donors and other funders, like foundations and government agencies, make informed giving decisions. This report:

- offers valuable information on fundraisers’ performance

- highlights trends in charitable fundraising

- provides guidance on how to evaluate a request for a charitable donation

- encourages giving throughout New York State

The Charities Bureau has oversight of professional fundraisers working for charities in New York State. These for-profit contractors are hired by charities to raise money. They must register with the Charities Bureau[1] and report on their charitable campaigns to the bureau.[2] To develop this report, we analyzed professional fundraisers’ financial results from their 2023 charitable campaigns in New York. The data is derived from interim and closing statements about these campaigns filed with the Charities Bureau. The analysis does not include fundraising done by charities’ employees or volunteers.

New York charities continue to experience a high demand for their services while facing operating and funding challenges. Charities rely on private donors, other funders and volunteer support to provide essential services that New Yorkers depend on. Despite inflation-related price increases and a competitive labor market, they continue to serve New Yorkers and enhance our quality of life.

Charitable organizations contribute much to New Yorkers’ lives and communities. In turn, New Yorkers give generously to support charities that provide disaster relief, health care, animal welfare, and many other worthy causes. Many charities are headquartered in New York, making our state one of the leading locations for charitable nonprofits in the United States.[3] As of October 2024, there were 98,127 charities registered with the Charities Bureau.

In addition to providing a broad range of community support, charities play an important role in New York’s economy. One example: In the fourth quarter of 2023, the nonprofit sector employed over 1.39 million New Yorkers and comprised 17 percent of private-sector jobs.[4],[5] A second example: In 2022 (the most recent year with data available), about 1.4 million New Yorkers who itemize deductions claimed $40.7 billion in charitable contributions on their tax returns.[6],[7] These numbers are in line with pre-pandemic giving numbers.

In recent years, the amount of money brought in by individual donations has decreased steadily as has the number of small donors.[8] At the same time, there has been a big increase in significant single gifts and in grants funded by large donor-advised funds (DAFs).[9] While large donations like these can provide a short-term boost to a charity, individual giving by committed donors helps create a robust civil society[10] in many ways. First, these donors believe their contribution makes a better community that they have a stake in.[11] Second, many charities operate with annual budgets of less than $500,000 and rely heavily on contributions from individuals.[12] In addition, relying too much on big donors can hurt an organization’s long-term financial health.[13],[14]

In 2023, charities faced rising prices, staffing shortages,[15] and the inability to offer competitive wages,[16] while at the same time grappling with the steady decline in the numbers of individual donors. A note about the trend in the number of donors: While fewer individuals gave, some actually gave more:[17] The dollar amount brought in by total giving increased by 1.9 percent compared to 2022.[18] However, total giving did not outpace inflation. All across New York, charities felt the pinch.[19]

Giving is not limited to money. Volunteers provide a vital resource to help many charities carry out their missions.[20] While some researchers find a decline in volunteerism,[21],[22] volunteers remain an important force powering charities’ success. In one example, the American Red Cross states that 90% of its workforce are volunteers.[23] In the summer of 2023, devastating rainfall across New York drove many people from their homes.[24] Red Cross volunteers[25] set up shelters in areas affected by heavy rains, flooding, road closures, and power outages.[26] In another example, Volunteer New York reported that last year it connected 35,000 volunteers to various projects and mobilized 455,000 hours of service.[27] These volunteers helped provide literacy programs, senior services, and aid to veterans and military families, and countless other kinds of support.[28]

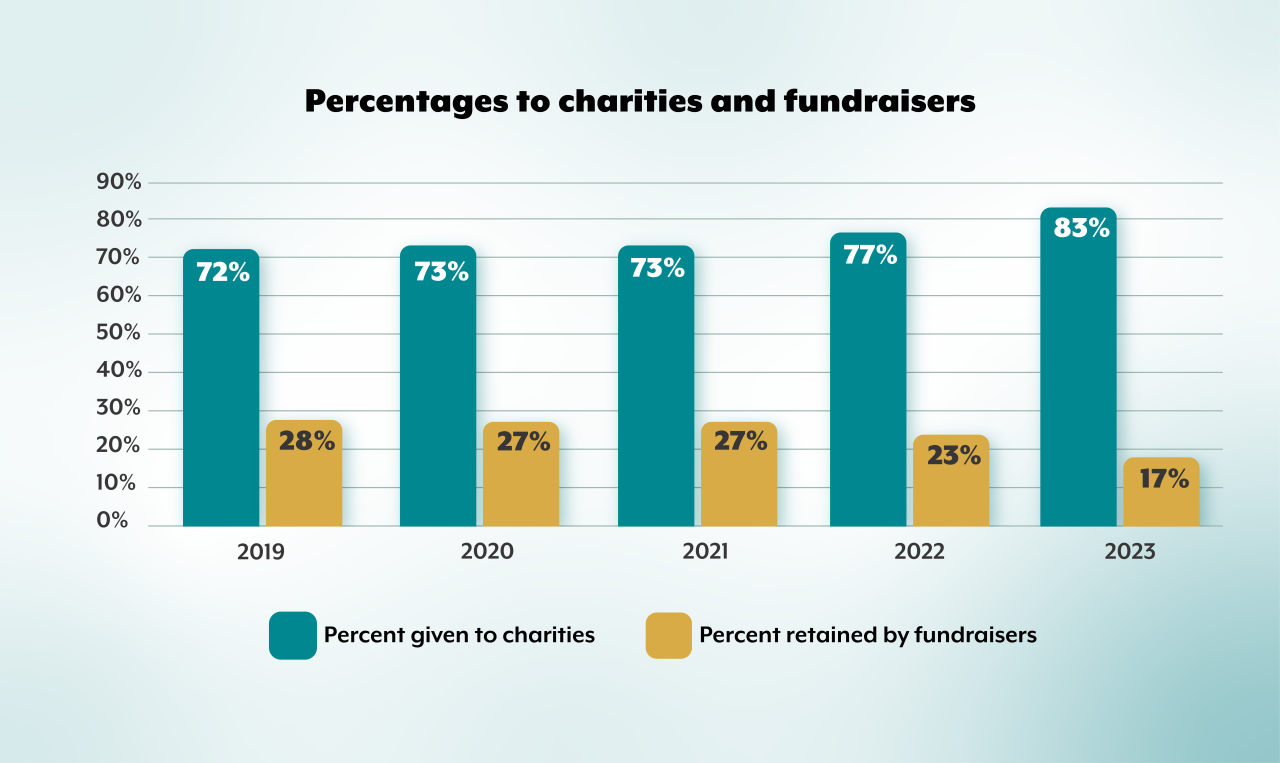

Many charities contract with for-profit professional fundraisers. They bring expertise in raising money from various donor groups. Professional fundraisers can play a key role in furthering a charity’s mission, and many belong to professional associations that require them to commit to a code of ethics.[29] In recent years, we have noted a steady improvement in the overall percentage of funds charities received from professional fundraisers’ campaigns compared to the amount the fundraisers retained as a fee (chart 1).

At the same time, these professional fundraisers face challenges specific to recovering from the pandemic. In recent years, donors tend to be more selective about which fundraising events to attend. Fundraisers also have had staffing shortages that limit their outreach to donors. In addition, they must deal with the shrinking donor pool. To offset this issue, they must continue to identify new audiences and donors while retaining existing ones.[30]

You, as an individual donor, can and do make a difference to charities’ important work. Grassroots giving and volunteering make our society stronger. Whether you choose to donate during the holidays, give to help communities recover from a disaster,[31] contribute to a cause close to your heart, or sign up for regular payroll deductions to support a charity,[32] you can use this report and other tools to give wisely to help ensure New York’s charities can continue their vital work.

Giving wisely: How to use this report

Do you know that a percentage of your charitable donation could go to a professional fundraiser, rather than to the charity?

Our report reflects the results of campaigns conducted by professional fundraisers on behalf of charities. In some, but not the majority, of those campaigns the fundraiser keeps as much as 90% of the contributions solicited. We developed this report to help raise awareness of the potential for this kind of split so that donors know to ask questions when they are asked to give.

Use our Pennies for Charity database to review a charity’s fundraising track record. It will show you what percentage of a professional fundraiser’s campaign went to the charity. If a charity frequently receives only a small percentage of funds raised, you may want to look further into how well that charity manages its fundraising and accomplishes its mission.

You can use our searchable registry to look up charities' financial reports. Charities registered with the Charities Bureau must submit annual financial reports that include information on their programs and finances.

In addition, look for information about charities in other resources, which evaluate charities on other factors. Some useful resources are:

Use our report and other resources to help you choose charities that will further your goals and line up with your charitable intentions.

How dollars went to charities ─ and to professional fundraisers

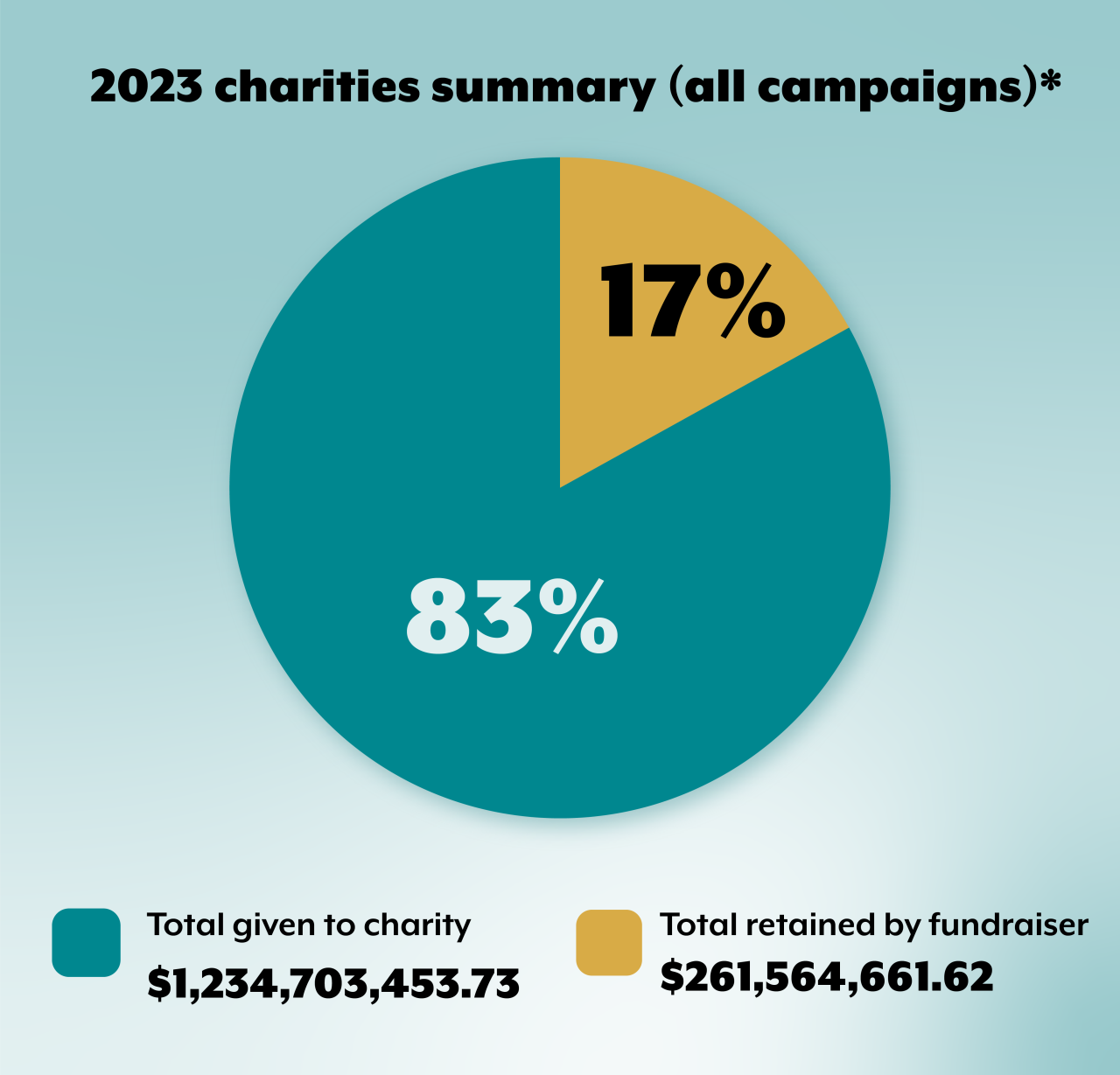

This year’s Pennies for Charity report includes data from 581 fundraising campaigns conducted in 2023 by professional fundraisers in New York. The campaigns raised nearly $1.5 billion overall, an increase in both number of campaigns and dollar amount over the previous year:

- There were nine more campaigns than in 2022.

- Campaign revenues increased more than $5.8 million compared with 2022.

- Gross receipts for 2023 fundraising campaigns totaled $1,496,268,115.35.

Other key findings include:

- Of the gross revenues, charities received over $1.234 billion from 2023 fundraising campaigns.

- Professional fundraisers retained more than $261 million. On average, these fundraisers kept 17 percent of funds raised to cover the costs of conducting the charitable campaigns and their fees.

- In 46 percent of campaigns, charities received less than 50 percent of funds raised.

- In 16 percent of the campaigns, expenses exceeded revenue, costing charities more than $26 million.

Figure 1. *Percentages in this report have been rounded to the nearest full percent

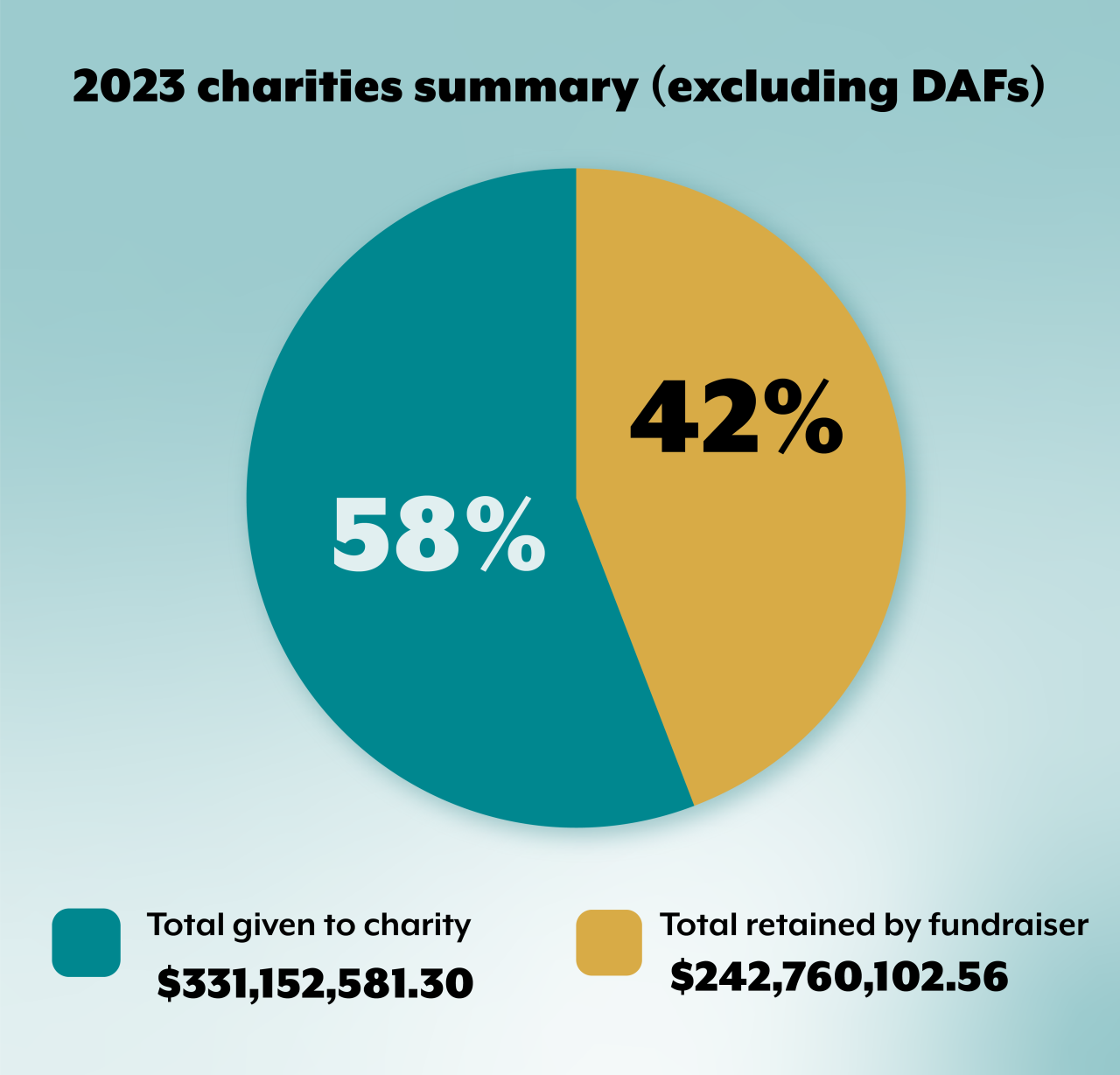

Donor-advised funds (DAFs) affect the giving landscape

Several donor-advised funds (DAFs) report their contributions from fundraising campaigns to the Charities Bureau. Chief among them are Network for Good, which partners with online platforms like YouTube, and Morgan Stanley’s Eaton Vance Distributors, which partners with U.S. Charitable Gift Trust. Nearly 62 percent of 2023’s total fundraising revenue was reported by these DAFs.

DAFs are run by sponsoring organizations that receive tax-exempt status as charities. Donors’ contributions to DAFs are deductible under Section 501(c)(3) of the Internal Revenue Code. Donors can request that the funds be given to certain charities or held until such time as the donor has determined where to direct their support. However, DAFs have control of the funds they receive from donors; they are not required to honor a donor’s intent. The Internal Revenue Service has posted information regarding DAFs on its website.[33]

An increasing share of charitable gifts flow through DAFs.[34] To illustrate the DAF campaigns impact on the Pennies results, we removed those campaigns for the following graphic. Note that this chart shows a significantly smaller percentage of funds raised — 58 percent — going to charities in 2023 (figure 2).

Figure 2.

When we include the DAF campaigns (figure 1), nearly 83 percent of funds collected by professional fundraisers went to charities. This trend lines up with an overall improvement over the past five years in the percentage of funds that charities retained from campaigns (chart 1). Several factors may contribute to this shift:

- Some charities have gotten better contractual terms from fundraisers than in previous years.

- There has been a decline in certain fundraising methods, such as telemarketing.

- There has been a steady decline in the number of contracts that give professional fundraisers more than 80 percent of the funds raised. In 2023, there 124 campaigns with such splits, down from 133 the previous year.

Chart 1.

Online appeals engage small donors – but online giving presents new challenges

Donations by individuals to organized charities continues to decline overall in the U.S. As recently as 2008, two-thirds of Americans gave to organized charities. Today, that fraction is less than half.[35] Online giving, however, has grown significantly, compared with donors writing checks. We have noted several important trends over the past few years:

Online giving grew as much as 12 percent in 2023 according to the Blackbaud Institute. Charities have generally benefited from this trend.[36] Donors find it quick and easy to click through; charities find that their online giving campaigns tend to cost considerably less than traditional fundraising campaigns. Most platforms charge charities fees ranging from 2.9% to 8% of the total amount raised in a charitable campaign, plus a modest per-transaction fee of about 20 to 50 cents.[37]

For smaller donors, online giving can be attractive because it provides them with a way to make a bigger impact over time. Some enjoy the convenience of automated deductions. Revenue from donors who commit to monthly online contributions rose 6 percent in 2023, according to M+R Benchmarks’ annual study of nonprofit giving.[38]

At the same time, charities can find it hard to sign up potential donors for automated giving. The M+R Benchmarks’ study also found that revenue from email campaigns has declined. In addition, while there has been an increase in peer-to-peer text messaging to promote charitable action, messaging has not yet proved an effective fundraising tool.[39]

Newer ways to give, such as online crowdfunding campaigns, can appeal to younger donors more than charities’ traditional campaigns.[40] These causes may not always be charitable. An individual appeal for rent money or money for a trip is not deemed a charitable solicitation by regulators. Even when the goal is to raise money for an established charity, donors often are not in direct contact with the charity itself. For instance, a campaign’s online organizer may gather all the contributions and send them to the charity. This sort of arrangement prevents the charity from developing important relationships with donors.[41]

In addition, popular donation platforms like GoFundMe have complicated the charitable landscape. Many younger donors want to make an impact but may not distinguish between a GoFundMe to help someone with education expenses and an appeal from a specific charity.[42] In some surveys, younger people express a preference to help an individual rather than an established charity. This sentiment may explain why crowdfunding continues its double-digit growth.[43] Many younger donors respond to social media alerts from friends. Charities that have found ways to harness this kind of appeal have benefited.[44]

The challenge, again, is that these donors may not realize that the appeals they see on online platforms like Facebook are not vetted. Some donors may not understand the risk that funds may not go to a charity. In addition, while GoFundMe offers a guarantee in case a campaign turns out to be fraudulent, many other platforms do not.[45] And some platforms are not transparent about their fees or policies.

Many states require registration and disclosure by charities and their professional fundraisers. But the laws typically apply only to traditional methods such as direct mail. At present, only two states require online charitable fundraising platforms to register:[46]

- In 2021, California approved the first law of its kind to regulate charitable fundraising online.[47],[48]

- In July 2024, Hawaii passed a similar bill.[49],[50]

New York does not yet have similar requirements for online charitable fundraising, although charities raising money in New York must register with the Charities Bureau. The Charities Bureau continues to evaluate the effect of California’s and Hawaii’s new laws.

Many users do not realize that when they make a charitable contribution through an online platform, it goes through a donor-advised fund (DAF) before reaching the charity they want to support. For instance, Facebook, the leading online platform for charitable campaigns,[51] partners with PayPal Giving Fund.[52]

When an online contribution flows through a DAF, the DAF will typically direct the gift to the intended charity. However, the DAF may wait to send the gift until contributions to that charity reach a certain threshold. In addition, the DAF may redirect gifts when charities do not meet their criteria.[53] While this circumstance is rare, this variance power is part of how DAFs work. If, for instance, an organization does not yet have IRS tax exemption, a DAF may refuse to grant it funds even though the charity was selected by the donor.

Telemarketers target smaller donors – but are they calling for a charity?

Telemarketing can be effective for furthering a charity’s message. Many campaigns target seniors who may be moved by touching appeals for “feel-good” causes. Stories of homeless veterans, children with cancer, and the like can resonate with donors. But be aware that such stories are also favorite tactics of fraud artists. And even a legitimate telemarketing campaign may not deliver all of your donation to a charity. So, use your judgment (see our guidance for handling a telemarketing solicitation). While most telemarketing campaigns raise and deliver funds to genuine charities, some fundraisers use misleading tactics to dupe people into contributing and their donations never go to support the services described.

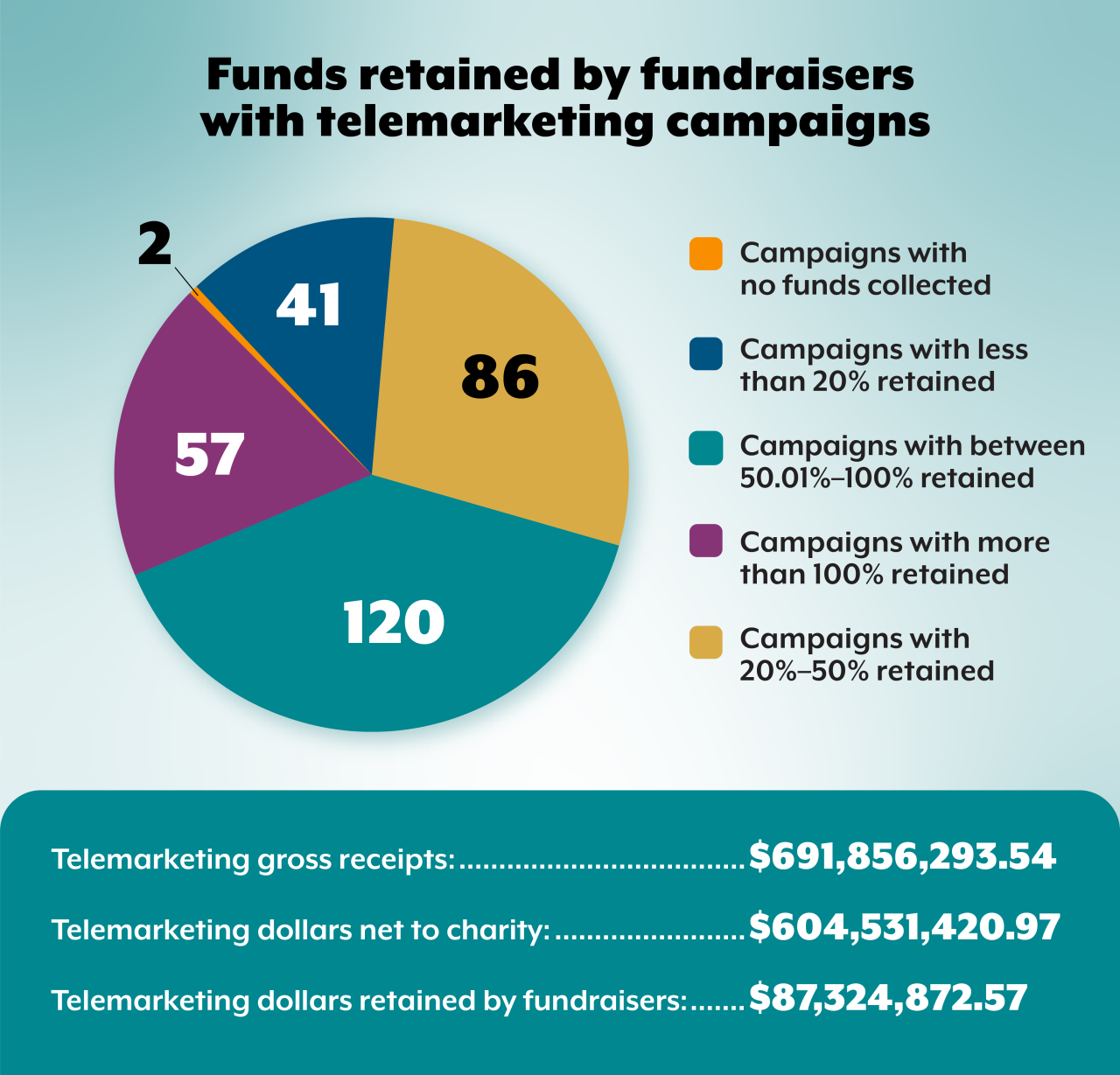

Due in part to state enforcement and education efforts to increase public awareness of telemarketing scams, the number of charitable telemarketing campaigns in New York has steadily declined. In 2021, there were 401 campaigns that used telemarketing in New York. That number dropped to 332 in 2022 and to 306 in 2023.

In addition, more of the funds raised by telemarketers are going to charities. The number of campaigns in which the telemarketer retained more than 50 percent of the collected dollars dropped from 129 in 2022 to 120 in 2023.

At the same time, some political action committees (PACs) have begun tapping professional fundraisers who use a similar type of heart-string appeal in their telemarketing campaigns to raise funds. Campaigns for these not-for-profit organizations may make them sound like charities, but they are not. PACs are not usually subject to the oversight of charity regulators (although some regulators view any organization that claims to be charitable to be subject to oversight).[54]

PACs are tax-exempt organizations formed under another section of the Internal Revenue Code than charitable organizations.[55] Contributions to a PAC are not tax deductible. Ask questions if you receive a call from an organization that you suspect may be a PAC before you support them.[56] In some instances much of the funds raised may not even go to lobbying elected officials but may be retained by the professional fundraiser conducting the campaign as a fee. (see tips to tell a charity from a PAC)

Such was the case with a group of PACs that hired Richard Zeitlin, who owned a telemarketing call center. The PACs that contracted with Zeitlin had charitable-sounding names like Children’s Leukemia Support Network, Standing by Veterans, and Americans for the Cure of Breast Cancer.[57] Zeitlin recently pleaded guilty in the Southern District of New York to a scheme to defraud donors.[58] His company typically took more than 90 percent of the funds raised in campaigns that appeared to be on behalf of breast cancer patients, veterans, and law enforcement officers. Many of the scripts Zeitlin’s callers used stated or implied that the organizations were providing specific assistance to those in need. In fact, none of the organizations were charitable and they did not provide any services.[59]

If you receive a call asking for money, do not feel obliged to respond on the spot. Before giving, confirm that the organization is actually charitable and has a track record you can evaluate.

The graphic below shows results of 2023 telemarketing campaigns.

Figure 3. This information is derived from filings with the Attorney General’s Charities Bureau.

What lies ahead for charities and fundraisers

Charities provide vital services that are in increasing need with each passing year. Fundraising is a lifeline for charitable organizations. As communities increasingly call on charities’ resources for help, fundraising becomes more critical in planning for and meeting societal needs.

Previous Pennies for Charity reports have noted a shift toward online fundraising nationwide. Online fundraising will likely continue to expand. A relatively new trend that may grow in coming years is AI technology. This technology, still in its infancy with charitable fundraising,[60] offers potential benefits for finding possible donors. AI can be used, for instance, to cull donor lists and prior giving history.[61]

For the present, charitable organizations continue to face challenges and rely more heavily than ever on individual donations. Research suggests a more hopeful giving year in 2024, where charitable giving may settle into a new normal and individual donors may be in a better position to give.[62],[63]

In conclusion, OAG applauds the work of charitable organizations and encourages charitable giving. Individual donors’ support makes a huge difference at a grassroots level.[64] In addition to funding worthy causes, giving can boost donors’ mental and physical well-being.[65] Although big gifts increasingly dominate the charitable sector, small donors’ support of local charities can help build and strengthen our communities.

We provide this report to help you, and all of New York’s donors, make wise choices that support charities’ good work.

[1]Registration and bond required. N.Y. Executive Law Section 173(1) (2014).

[2]Contracts of professional fund raisers, fund raising counsel and commercial co-venturers; closing statements; final accountings. N.Y. Executive Law Section 173-a(1) (2014).

[3] Internal Revenue Service (n.d.). Exempt Organizations Business Master File. Retrieved October 2, 2024, from https://www.irs.gov/charities-non-profits/exempt-organizations-business-master-file-extract-eo-bmf. New York has 118,739 501(c)(3) organizations filing with the IRS, an increase over 2023’s number of 117,791.

[4]Source: Email correspondence from New York State Dept. of Labor. (personal communication, August 8,2024).

[5] Data can be found at www.dol.ny.gov/quarterly-census-employment-and-wages

[6]Source: Email correspondence from New York State Dept. of Tax and Finance (personal communication, August 16, 2024).

[7] Data can be found at www.tax.ny.gov/research/stats/statistics/pit-filers-summary-datasets-beginning-tax-year-2015.htm.

[8] Childress, R. (2024, June 25). Giving continues its decline, down 2.1% in 2023. Can fundraisers turn the tide in 2024? Chronicle of Philanthropy. https://www.philanthropy.com/article/giving-continues-its-decline-down-2-1-in-2023-can-fundraisers-turn-the-tide-in-2024

[9] Meyer, J. (2023, August 28). 5 strategies to implement based on Giving USA 2023. Givingusa.org. www.givingusa.org/5-strategies-to-implement-based-on-giving-usa-2023/

[10] The Generosity Commission. (September 2024). Everyday actions, extraordinary potential: the power of giving and volunteering.https://www.thegenerositycommission.org/wp-content/uploads/2024/09/DIGITAL_TGC_FullReport_092424.pdf

[11] Gose, B., & Childress, R. (2024, July 9). Everyday donors want to give. Here’s how to find them. https://www.philanthropy.com/article/everyday-donors-want-to-give-heres-how-to-find-them

[12]Everyday actions, extraordinary potential. See note 10.

[13] Childress, R. (2024, June 25). Charitable donations continue to decline, down 2.1% in 2023, according to a new Giving USA report. Associated Press. https://apnews.com/article/giving-usa-report-philanthropy-indiana-university-lilly-school-9a6f1dedf4f88b5809debf75cbda02a2

[14] Everyday donors want to give. See note 11.

[15] National Council of Nonprofits. (August 2023). Nonprofit workforce shortage survey in New York. https://www.councilofnonprofits.org/files/media/documents/2023/2023-new-york-nonprofit-workforce-shortages-report.pdf

[16] New York Council of Nonprofits. (n.d.). State of the sector 2023. https://www.nycon.org/storage/documents/Documents_for_Linking/2023%20state%20of%20the%20sector.pdf

[17] AFP. (2024, April 7). Year-end challenges in Q4 2023 as fundraising metrics decline. https://afpglobal.org/news/year-end-challenges-q4-2023-fundraising-metrics-decline

[18] Giving USA. (2024, June 25). Giving USA: U.S. charitable giving totaled $557.16 billion in 2023. https://philanthropy.indianapolis.iu.edu/news-events/news/_news/2024/giving-usa-us-charitable-giving-totaled-557.16-billion-in-2023.html

[19] State of the sector 2023. See note 16.

[20] National Council of Nonprofits. (n.d.). Volunteers. www.councilofnonprofits.org/running-nonprofit/employment-hr/volunteers

[21] Philanthropy News Digest. (2023, December 12). American volunteerism continues to decline, studies find. https://philanthropynewsdigest.org/news/american-volunteerism-continues-to-decline-studies-find

[22] Chronicle of Philanthropy. Lenkowsky, L. (2023, February 14). Americans are volunteering less. What can nonprofits do to bring them back? Chronicle of Philanthropy. https://www.philanthropy.com/article/americans-are-volunteering-less-what-can-nonprofits-do-to-bring-them-back

[23] American Red Cross. (n.d.) Become a volunteer. Retrieved November 1, 2024, from https://www.redcross.org/volunteer/become-a-volunteer.html

[24] Supardi, B. (2023, July 10). Northeastern NY Red Cross provides aid to areas hit with deadly flooding. CBS 6 Albany. https://cbs6albany.com/news/local/northeastern-ny-red-cross-provides-aid-to-areas-hit-with-deadly-flooding

[25] Callahan, R. (n.d.). The shelter at Highland Falls. Official blog of the American Red Cross Eastern New York region. https://redcrosseny.blog/2023/07/21/the-shelter-at-highland-falls/#more-5118

[26] Reilly, B. (2023, July 11). Young volunteers help flood victims at American Red Cross shelter. Spectrum News 1. https://spectrumlocalnews.com/nys/central-ny/news/2023/07/11/young-volunteers-help-flood-victims-at-american-red-cross-shelter

[27] Volunteer New York. (n.d.). Retrieved November 1, 2024, from www.volunteernewyork.org

[28] Volunteer New York. (n.d.). Retrieved November 1, 2024, from www.volunteernewyork.org

[29] AFP. (n.d.). Code of ethical standards. Retrieved November 1, 2024, from Association of Fundraising Professionals at www.afpglobal.org/ethicsmain/code-ethical-standards

[30] Shelley, Craig. (2024, September 30). Zoom meeting with Craig Shelley, Partner, Orr Group and OAG.

[31] OAG. (2023, September 29). Attorney General James warns New Yorkers of price gouging on essential goods in aftermath of heavy rainstorms in New York [press release]. https://ag.ny.gov/press-release/2023/consumer-alert-attorney-general-james-warns-new-yorkers-price-gouging-essential

[32]Attorney General James warns New Yorkers of price gouging on essential goods in aftermath of heavy rainstorms in New York. See note 31.

[33] www.irs.gov/charities-non-profits/charitable-organizations/donor-advised-funds

[34]https://blog.candid.org/post/donor-advised-funds-daf-growth-popularity-in-philanthropy

[35]Everyday actions, extraordinary potential. See note 10.

[36] Blackbaud Institute. (April 2024). Blackbaud Institute spotlight: 2023 trends in giving. https://live-blackbaud-institute.pantheonsite.io/wp-content/uploads/2024/04/BBI_2023_Trends_Spotlight_2024-Final.pdf

[37] GoFundMe. (n.d.). The top 6 online fundraising sites and how they compare. Retrieved November 1, 2024, from https://www.gofundme.com/c/blog/online-fundraising-sites

[38]Benchmarks. (n.d.). M&R. Retrieved November 1, 2024, from https://mrbenchmarks.com/

[39]Benchmarks. See note 38.

[40]Benchmarks. See note 38.

[41] Meeting with Shelley, C. See note 30.

[42] Ford, C. (2024, July 10). Are we actually in the middle of a generosity crisis? Vox. https://www.vox.com/future-perfect/359526/charitable-giving-generosity-crisis-report-americans-young

[43]Are we actually in the middle of a generosity crisis? See note 42.

[44] Double the Donation. (n.d.). Nonprofit fundraising statistics to boost results in 2024. Retrieved on November 1, 2024, from https://doublethedonation.com/nonprofit-fundraising-statistics

[45] GoFundMe. (n.d.). GoFundMe giving guarantee. Retrieved on November 1, 2024, from https://www.gofundme.com/c/safety/gofundme-guarantee

[46] Office of the Attorney General, State of California. (2021, October 7). Attorney General Bonta and Assemblymember Irwin’s legislation to provide oversight of online charitable fundraising platforms signed into law [press release]. https://oag.ca.gov/news/press-releases/attorney-general-bonta-and-assemblymember-irwin%E2%80%99s-legislation-provide-oversight

The statute defines charitable fundraising platforms as those like GoFundMe that run campaigns. These partner with platform charities like PayPal Giving Fund to allow users to receive a charitable deductive for their gift.

[47] Attorney General Bonta and Assemblymember Irwin’s legislation to provide oversight of online charitable fundraising platforms signed into law. See note 46.

[48]Supervision of Trustees and Fundraisers for Charitable Purposes Act, Title 2, section 12599.9 (2020). https://leginfo.legislature.ca.gov/faces/codes_displaySection.xhtml?lawCode=GOV§ionNum=12599.9

[49]Relating to solicitation of funds from the public, Hawaii Senate bill 2983. (2024). https://legiscan.com/HI/bill/SB2983/2024

[50]Relating to solicitation of funds from the public. See note 49.

[51]Relating to solicitation of funds from the public. See note 49.

[52] Facebook. (n.d.). Charitable giving with Paypal Giving Fund. Retrieved on November 1, 2024, from https://www.facebook.com/help/972138750728970

[53] Donor-advised funds. See note 33.

[54] Sollenberger, R. (2021, October 11). Political groups try new tricks and rake in millions. Daily Beast. www.thedailybeast.com/scam-political-groups-try-new-tricks-and-rake-in-millions-pacs-charities

[55] Political organizations, 26 U.S.Code section 527 (1986). https://www.govinfo.gov/content/pkg/USCODE-2023-title26/pdf/USCODE-2023-title26-subtitleA-chap1-subchapF-partVI-sec527.pdf

[56] Farenthold, D. & Fehr, T. (2023, May 14). How to raise $89 million in small donations, and make it disappear. New York Times. https://www.nytimes.com/interactive/2023/05/14/us/politics/scam-robocalls-donations-policing-veterans.html

[57] U.S. Attorney’s Office, Southern District of New York. (n.d.). United States v. Richard Zeitlin. Retrieved November 1, 2024, from https://www.justice.gov/usao-sdny/united-states-v-richard-zeitlin

[58] U.S. Attorney’s Office, Southern District of New York. (2024, September 10). Owner of telemarketing call center business pleads guilty to multi-year scheme to defraud PAC donors [press release]. https://www.justice.gov/usao-sdny/pr/owner-telemarketing-call-center-business-pleads-guilty-multi-year-scheme-defraud-pac.

[59]United States v. Richard Zeitlin. See note 57.

[60] Good 360. (2023, June 14). How nonprofits can use AI to increase fundraising and engagement. www.good360.org/blog-posts/how-nonprofits-can-use-ai-to-increase-fundraising-and-engagement/

[61] Childress, R. (2024, September 9). The A.I. that’s already raising money. Chronicle of Philanthropy. https://www.philanthropy.com/article/the-a-i-thats-already-raising-money

[62] Giving continues its decline, down 2.1% in 2023. See note 8.

[63] ScholarWorks Indianapolis. (n.d.). The philanthropy outlook 2024-2025 report. Retrieved November 1, 2024, from https://scholarworks.indianapolis.iu.edu/items/499ae1f5-c885-4aa3-aa49-1f27534dd096

[64] Council of Nonprofits. (n.d.). Nonprofit impact in communities. Retrieved November 1, 2024, from www.councilofnonprofits.org/about-americas-nonprofits/nonprofit-impact-communities

[65] Cleveland Clinic. (2022, December 7). Why giving is good for your health. https://health.clevelandclinic.org/why-giving-is-good-for-your-health

Tips for donors

Donating online or via an app can be convenient for donors and cost effective for charities. But, even when an appeal is posted by someone you know, check that a campaign is legitimate and that your donation will go to the intended charity. You can always go directly to a charity’s secure website to donate. Keep in mind that some contributions may not be tax deductible, such as GoFundMe campaigns to help individuals with specific goals.[66] In addition to the following tips, you can find helpful guidance at the Federal Trade Commission’s website.[67]

Crowdfunding

Crowdfunding platforms reach wide audiences to help raise money for campaigns. However, these platforms do not generally vet the campaigns they host. Be aware that the money from a crowdfunding campaign generally goes to the campaign’s organizer: You and other donors may not be told how much ends up going to the cause.[68] In addition, check what fees will be charged and make sure that the charity has given its permission for the use of its name or logo. A charity will be able to confirm that it has approved a specific crowdfunding campaign. To avoid scams, give only to campaigns conducted by people you know and check that any provided links point to the intended organization.

Social media

Many Americans now contribute through social media apps, such as Instagram or Facebook. It is easy to understand why these are so popular: With just a few clicks, you have an easy way to give. But, with so many scam posts going around, take the time to ensure the post ─ and request ─ are legitimate. A quick check of the charity’s official website or verified social media page can help you confirm that an appeal is valid.

Text donations

Text donations are simple and effective methods of fundraising. At the same time, texts asking for donations might be fraudulent. Some of these messages provide a code to send the donation; others provide links. As with other types of solicitations, dig further and research the link or code to ensure that it points to a legitimate organization and campaign.

Secure web addresses

When donating online, make sure the website is secure: The web address should start with “https.” The site may also show a padlock symbol, indicating it is secure and encrypted. Unless the charity uses a separate payment site, the web address should match that of the charity that will receive the donation.

Spam email

Be wary of email solicitations that ask you to click a link or open attachments. These could be phishing scams that try to trick you into giving out your credit card number, Social Security number, or other confidential information. Research the link to be sure it is not malicious.

In the wake of a disaster like a tornado or widespread flooding, New Yorkers are eager to help. Unfortunately, fraudulent organizations can take advantage of these good intentions.

Here are some guidelines to donating to disaster-relief efforts:

- Donate to charities you have heard of and that have experience in disaster relief.

- Check a website like The Center for Disaster Philanthropy to find out which charities are at the aid forefront.

- Check the charity’s website: Has it worked in the affected area or does it partner with local relief organizations?

- Does the charity say how it plans to use a donation?

- Does the campaign have a specific dollar goal? If so, what will be done with excess donations?

- Once you pick a charity, vet its track record. Websites such as Charity Navigator can help gauge how well charities have accomplished their mission.

When donating to overseas disaster relief, choose a reputable organization working in the affected area. Agencies such as the American Red Cross, United States Agency for International Development, and the United Nations offer valuable information on the best ways to lend support.

If you think an organization could be fraudulent, please contact the Charities Bureau Complaints Section at charities.complaints@ag.ny.gov.

New York law requires telemarketers soliciting for charities to make certain disclosures to potential donors. The law prohibits telemarketers from making false, misleading, or deceptive statements when soliciting contributions.

Telemarketers must provide you with certain information

If you receive a call from a telemarketer, you must be told:

- The name of the individual telemarketer

- If the solicitation is being conducted by a telemarketer employed by a professional fundraising company and, if so, the name of the company

- That the telemarketer is being paid to make the call[69]

Do not feel pressured to give over the phone

If you choose to consider the caller’s request, ask:

- What programs are conducted by the charity? Ask for specifics.

- Is the caller a paid telemarketer?

- What percentage of your donation will the charity receive?

You can ask to be placed on that charity’s “do not call” list

Even if you have already put your name on the Federal Trade Commission’s “do not call” list, tax-exempt, non-profit organizations are still allowed to call you.

If a telemarketer calls to request a contribution:

- Ask whether the organization is a charity and whether your contribution will be tax deductible. If it is actually a political action committee (PAC), it must inform you and other donors that contributions are not tax deductible.[70]

- Ask what portion of your donation will be applied to charitable activities and which programs will benefit.

- If you need more information, check the Federal Election Commission database of PACs to see if the organization is listed. If so, the PAC will include its most recent mission statement and funding.

- Be aware that, if you give over the phone, you are likely to receive more telephone solicitations. Once you donate, your name, number, and donation history are valuable assets that can be sold or shared with other organizations. You can request that the organization not sell your information, but there is no way to ensure they will follow your request.[71]

If you receive a charitable solicitation in the mail, take a close look at what you have been sent. Here is our checklist of things to look for:

- Does the organization have a name that sounds like a well-known charity?

- Double-check the organization online. Is it the one you think it is?

- Does the mailing claim to follow up on a pledge that you do not remember making? Keep records of your pledges so you will not be scammed.

- Does the mailing state that a copy of the charity’s most recent financial report can be viewed in the Charities Bureau’s registry or obtained directly from the charity?

- Does the mailing clearly describe the programs or activities that the charity plans to fund with your donation, or include a statement that a detailed description of those activities is available upon request?

As an officer or director of a charity, you have an obligation to oversee any professional fundraiser your charity hires. Your charity’s reputation is one of its most valuable assets, and a professional fundraiser may be your primary connection to the public. Make sure that a fundraiser represents your charity well and fulfills all regulatory requirements.

Before hiring a professional fundraiser:

- Research the fundraiser’s track record using the Pennies for Charity database on the Charities Bureau’s website. The database shows how much charities have retained from campaigns conducted by fundraisers. If a fundraiser’s campaigns yielded little for charities, it may be a red flag.

- Ensure that the fundraiser is properly registered. Fundraising professionals must register annually with the Office of the New York State Attorney General’s Charities Bureau to fundraise in New York State.[72] To find out if a fundraiser is registered, email charities.fundraising@ag.ny.gov or call (518) 776-2160.

- Charities must have a written contract with a fundraiser that includes certain terms. New York law requires that specific financial terms and cancellation language be included in fundraiser contracts.[73] The law also requires that, within five days of receipt, all contributions must be placed in an account controlled by the charity.[74]

- If an organization agrees to a contract that allows the fundraiser to keep a percentage of the funds raised, be aware that there is no “industry standard” for such contracts, so ensure that the terms maximize the returns to the charity.

- Your charity should retain control of the lists of contributors. Make sure that a fundraiser’s contract makes your charity the owner of the list of its contributors. Otherwise, the fundraiser may be able to use, sell, or rent the list for other organizations.

- If your charity raises funds by telemarketing, make sure that the fundraiser makes the required disclosures. New York law requires that fundraising professionals and their representatives (“professional solicitors”) disclose to a potential donor all of the following: the professional solicitor’s name and the name of the fundraising professional in charge of the campaign, and that the solicitor is being paid to raise funds.[75]

- Once the campaign has ended, closely review the fundraiser’s financial report before you sign it. Fundraisers must file a financial report with the OAG’s Charities Bureau disclosing a campaign’s results (Form CHAR037). New York law requires that both a charity and its fundraiser certify the accuracy of the report, under penalty of perjury.[76] Your charity is obligated to review a campaign’s accounts and costs prior to signing. Form CHAR037 must be submitted within 90 days after a fundraising campaign concludes.

[66] Federal Trade Commission. (n.d.). Donating through crowdfunding, social media, and fundraising platforms. Retrieved on 11/1/24 from https://consumer.ftc.gov/articles/donating-through-crowdfunding-social-media-and-fundraising-platforms

[67] Donating through crowdfunding, social media, and fundraising platforms. See note 66.

[68] Donating through crowdfunding, social media, and fundraising platforms. See note 66.

[69] Solicitation, N.Y. Executive Law section 174-b(3) (2019). https://www.nysenate.gov/legislation/laws/EXC/174-B

[70] See https://www.fec.gov/help-candidates-and-committees/making-disbursements/fundraising-notices-campaigns/

[71] National Association of State Charity Officials. (n.d.). NASCO issues guidance regarding scam PACs. https://www.nasconet.org/2024/10/1823/

[72] Professional fund-raisers, commercial co-venturers and fund raising counsel. N.Y. Executive Law section 173 (2014).

[73] Solicitation by unregistered charitable organizations, professional fund-raisers or commercial co-venturers a fraud… N.Y. Executive Law section 174-a(2),(4) (2014).

[74] Contracts of professional fund raisers, fund raising counsel and commercial co-venturers; closing statements; final accountings. N.Y. Executive Law section 173-a(2) (2014).

[75] Solicitation, N.Y. Executive Law section 174-b(3). See note 69. See also https://ag.ny.gov/sites/default/files/2023-02/disclosure-notice.pdf

[76] Contracts of professional fund raisers, fund raising counsel and commercial co-venturers; closing statements; final accountings. N.Y. Executive Law section 173-a(1). See note 74.