Pig-butchering scams

Be alert. Protect yourself.

What is a pig-butchering scam?

In this type of scam, a scammer targets a victim and gradually gains their trust. The scammer convinces the victim to give them money for “investments.” The “investments” are fraudulent – the scammer is simply stealing the victim’s money. The name “pig butchering” refers to the process of “fattening up” victims by gaining their trust before taking their money.

Download a printable version of this publication

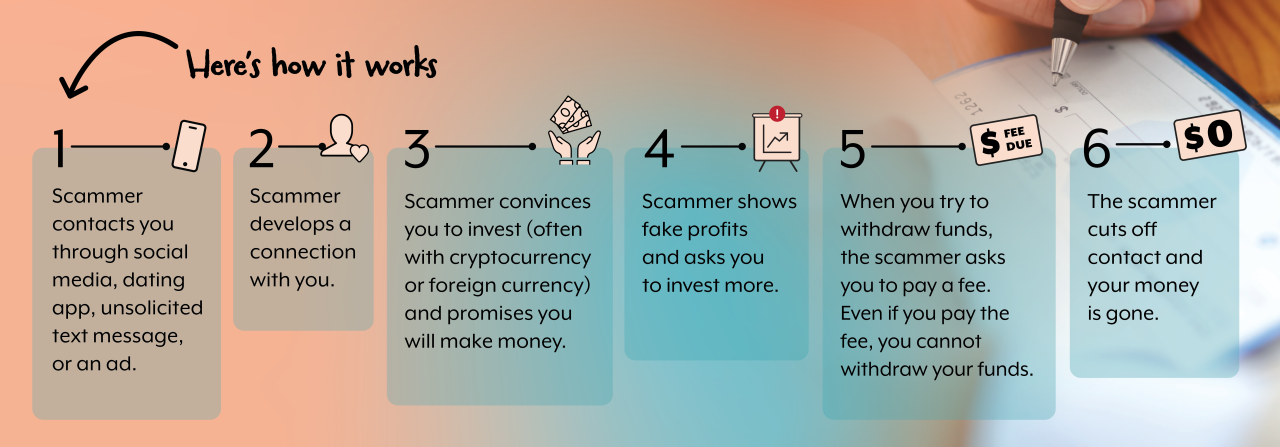

How does it work?

Scammers operating these schemes are patient, careful, and heartless. They often work in teams. They may target you if they think you are lonely, isolated, or vulnerable. They pretend to build a connection with you. Then they prey on your trust to steal your money. A scam usually unfolds in the following way:

- A scammer contacts you via social media, dating app, or text messages. They try to transition your conversation to an encrypted chat platform, such as WeChat, WhatsApp, Signal, or Telegram. They use encrypted platforms to shield their identity from law enforcement.

- The scammer spends a long time building a connection to gain your trust. They make you believe you’re in a close personal relationship, as romantic partners or friends. Or they develop a fake professional connection, posing as your trustworthy financial advisor.

- After the scammer has won your confidence, they shift the conversation to trading or investment opportunities. They introduce you to an investment opportunity, often in cryptocurrency or foreign currencies. The scammer can use various tactics to pose as a successful investment expert, such as:

- They may share screenshots showing how much they have made on trading platforms. Or they might send you photos of the expensive houses, jewelry, or cars they own.

- The scammer may refer you to websites that appear legitimate. This could be a famous bank or investment firm, but there is a slight misspelling in the name, or the website is a little bit different.

- The scammer may ask you to download apps. Even if these apps appear on popular platforms like Apple’s App Store or the Google Play Store, they have no connection to any legitimate software provider. They are simply a channel to separate you from your money.

- After convincing you to “invest,” the scammer makes you believe that you are making incredible returns. They might do this in a number of ways, such as:

- showing fake account balances on online statements, investment platforms, or apps that increase over time

- offering you a loan or giving you funds to trade with on their chosen platform

- give you a modest cash payment – that may have been stolen from another scam victim.

- You continue to place more trust in the scammer. You invest more funds.

- After you have deposited a lot of money into the platform, you are unable to withdraw funds, or the scammer asks you to pay “withdrawal” fees to get your money back and you still cannot withdraw your funds.

Now having successfully stolen your money, the scammer cuts off contact. But they may not be finished.

A cruel “second act”

When you think you have finally escaped the scammer, one of their associates might try to reel you back in. This look something like the following:

- Days or months later, you hear from someone who promises they can retrieve the money you’ve lost. They know exactly how much you lost. They promise to get back everything you lost, plus big profits – for a small fee.

- Once you have paid the fee, they tell you they have secured the funds. They promise to return your money as soon as you pay the taxes.

- If you pay the “taxes,” they come up with new fees that you must pay.

- You will never see your money again.

How to protect yourself

Watch out for red flags: While scammers are skilled in gaining your confidence, they also have telltale behaviors you can use to spot them.

Be suspicious of anyone who:

- warns you not to tell anyone about your relationship with them, or the investment opportunities they are offering you

- interferes when your bank or brokerage questions a transaction they have instructed you to do

- asks you for detailed personal financial information

- wants you to send them private or risky photos, which they could later use against you

- promises to meet in person or by video call, but always has an excuse about why they cannot meet. Keep in mind that even video calls can be deepfaked, so be suspicious of anyone who cannot meet in person.

- instructs you to hand cash or check to a courier or delivery person (who may not even know they are participating in a scam)

- requests to move your conversation from text and email to WeChat, WhatsApp, or another encrypted platform

Tips to stay safe:

- Do not wire money, send cryptocurrency, or give cash to people you don’t know. You cannot undo these transactions.

- Research the person. Do web searches to see whether their image, name, or details appear elsewhere online – and whether they have been faked or belong to someone else. Scammers may use stolen identities, or could use AI to generate their profiles and pictures.

- Be suspicious if someone pressures you to invest within a very short time frame, and claims you will lose out on an opportunity.

- Consult a trusted legal professional or financial advisor who can advise you on investment opportunities.

- Never rush into any investment. If it seems too good to be true, it probably is.

Report a scam or file a complaint

If you believe you have been victimized by a “pig-butchering” scam, contact our office.