Health Care Bureau Annual Report 2023-2024

Real Solutions for New Yorkers

In this report

> 2023-2024 at a glance

> Helpline callers’ most-common complaints

> How OAG has helped New Yorkers

> Provider billing practices

> Wrongful practices

> Claim-processing and payment problems

> Health-plan denials of coverage for care

> Obtaining and keeping coverage

> Access to prescription drugs

> About the OAG Health Care Bureau

> Conclusion

2023-2024 at a glance

The Health Care Bureau’s helpline makes it easy for New Yorkers to communicate their health care concerns to the Office of the New York State Attorney General (OAG). Serving as the OAG’s front line for health care, the helpline’s team of advocates takes New Yorkers’ complaints for review and resolution.

In 2023, New Yorkers filed 3,508 complaints with the helpline, requesting assistance or information about health care, and submitting other inquiries. Helpline staff handled these as follows:

- evaluated and directly handled 2,346 complaints at the advocate level

- assessed, then provided information or referrals for the remaining 1,162 complaints

In 2024, New Yorkers filed 3,305 complaints with the helpline, whose staff:

- evaluated and directly handled 2,457 complaints at the advocate level

- assessed the remaining 848 complaints, then provided the callers with information or referred them to agencies best equipped to handle the inquiries

These complaints highlight the challenges New Yorkers face and help identify systemic problems in New York’s health care system. In addition, these complaints often provide the basis for further investigation and enforcement actions against health plans, providers, and other entities in the health care market.

During 2023 and 2024, OAG secured more than $4.63 million for New Yorkers in restitution and savings. The OAG recovered and saved these funds by:

- correcting erroneous medical billing

- reversing wrongfully rejected and correcting inaccurately processed health insurance claims

- rectifying companies’ wrongful business practices

In addition, through the helpline, OAG helped New Yorkers obtain medically necessary care and prescriptions where health plans had denied coverage. Helpline staff also assisted in reinstating health insurance where health plans had incorrectly terminated coverage.

The main issues for which New Yorkers call the helpline are:

- incorrect billing

- health plan errors

- uncertainty about benefits

- rules to follow to obtain coverage

- appeal rights

- referral information to other agencies that deal with health care issues outside OAG’s scope

While its staff cannot resolve all complaints and inquiries favorably, the helpline plays a crucial role as a source of reliable and objective information for New Yorkers.

Helpline callers’ most common complaints

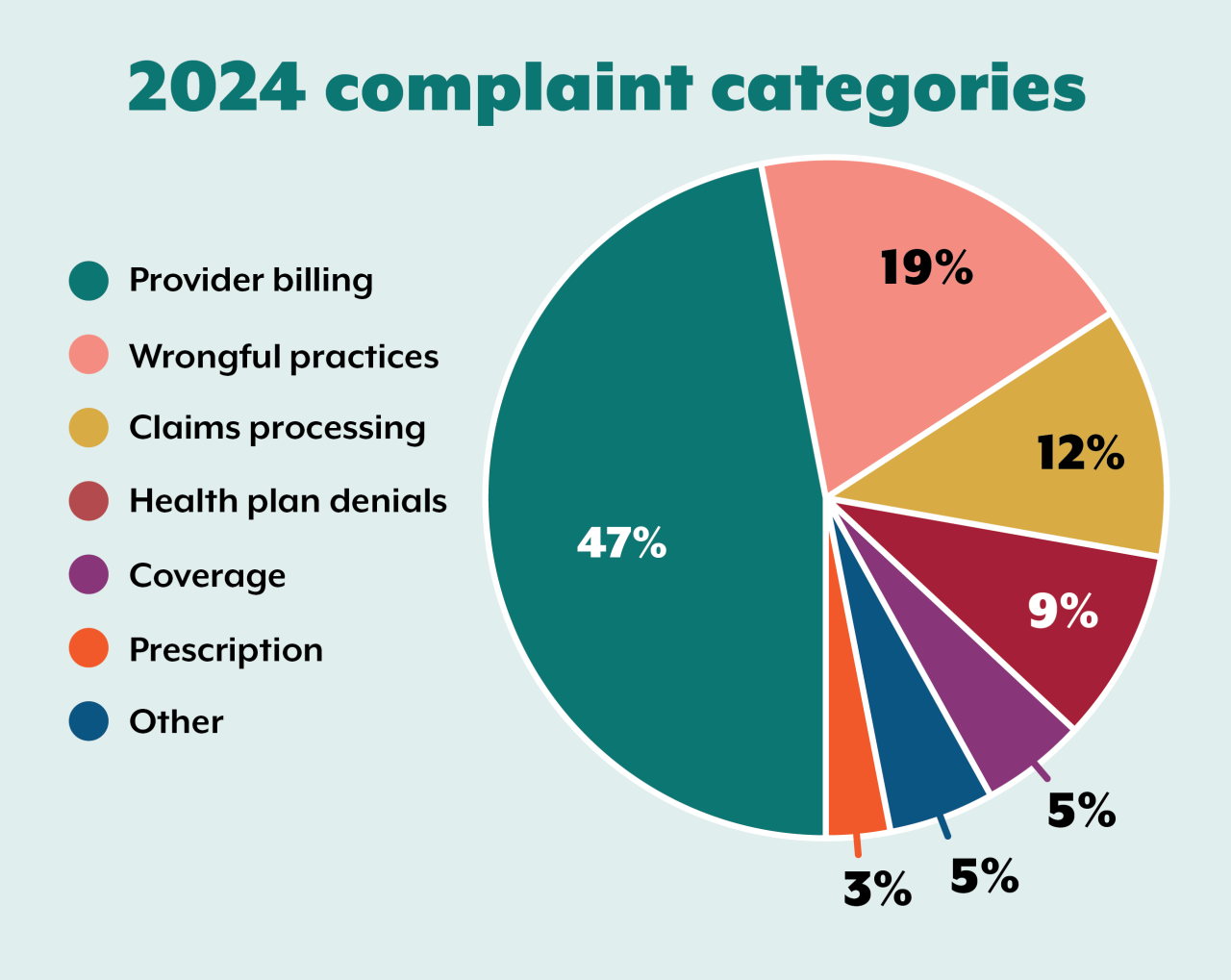

Complaints to the helpline fall into six general categories: provider billing, wrongful practices, claims processing, health plan denials, insurance coverage, and prescription drugs. Most of these complaints concern incorrect provider billing and wrongful or improper claims processing.

In 2023 and 2024, most complaints to the helpline were about incorrect medical billing, including by private physician practices and hospitals. These issues typically include the following situations:

- a provider fails to submit or incorrectly submits a claim to an insurance company

- there is duplicate billing

- a patient is incorrectly balance billed*

Incorrect billing has been the number one issue raised by New Yorkers to the helpline since 2011. The following graphs show the breakdown of complaints for 2023 and 2024.

*Balance billing occurs when a provider bills a patient for the difference between the amount the provider is charging and the amount the patient’s health plan paid. When a provider is in the patient’s network, the provider is not allowed to balance bill the patient, except for coinsurance, copayment, and deductible: The provider agrees to accept the insurance plan’s payment as payment in full. When a provider is not in the health plan’s network, however, balance billing is not improper.

How OAG has helped New Yorkers

Highlights: Helpline resolutions and OAG enforcement resolutions and actions

Here are further details on the most common issues prompting calls to the helpline, and how OAG helped resolve them in specific cases.

Provider billing practices

Erroneous provider bills, unfortunately, are not uncommon, can be costly, and can even lead to referrals to collection agencies or legal judgments. In 2023, a significant number of complaints ─ 50 percent ─ involved improper provider billing. In 2024, 47 percent of complaints concerned provider billing practices. Listed below are some of the complaints received and resolved by the helpline in this area:

A provider billed a patient’s insurance $63,172 for an MRI with contrast, $59,700 of which was for Glucagon HCl per 1 mg. After their insurance processed the claim, the consumer owed $0 for the MRI, but more than $5,000 for the medication. The consumer contacted the helpline. An OAG advocate discovered that the provider had mistakenly billed for 150 units of medication instead of one single unit. The advocate followed up. Further investigation determined that the overbilling had also happened with other consumers, as far back as 2017. The provider indicated that they had incorrectly billed insurance more than $530,000 for 59 other consumers. Of these other consumers, 14 patients were refunded $3,370 each, while the remaining 44 patients had no change in patient responsibility.

A consumer contacted the helpline when she received a $160 bill after her annual well-woman preventive visit. The OAG determined that the provider had not billed the visit with the appropriate preventive-medicine billing code. The OAG asked the provider to determine if the claims should be resubmitted with preventive diagnosis codes. The provider responded that they had billed the patient correctly. The OAG then contacted the insurance company regarding the appropriate coding under the insurer’s billing guidelines. The insurance company agreed that the provider had billed the preventive visit incorrectly and removed all cost-sharing for the consumer.

A consumer complained that they had been billed for three appointments that did not take place. In addition, they had been billed for psychotherapy services during two of the appointments, although they did not receive any psychotherapy services during their visits to the provider. The consumer contacted the helpline and OAG was able to obtain a $0 balance statement from the provider.

A consumer contacted the helpline after paying $5,800 up front for his cataract surgery because the insurance company would not reimburse him for the surgery. An OAG advocate contacted the insurance company. The insurance company told OAG that the patient’s ophthalmic provider had indicated the consumer had signed a waiver stating that they understood that the procedure they received would not be covered by insurance. The insurance company asked the ophthalmic provider to provide the waiver, but the provider did not produce a copy of it. The ophthalmic provider issued the consumer a full $5,800 refund.

A consumer was billed $6,018 for laboratory services. His insurance carrier also sent him an explanation of benefits indicating member responsibility was $0. The consumer tried multiple times, without success, to have the lab waive the bill before contacting the helpline. The OAG sent an inquiry to the lab. The lab responded by waiving the bill and sending a letter to the consumer indicating that the patient’s responsibility was $0.

Upon being admitted to a hospital, a consumer showed documentation that he qualified for financial assistance as an individual experiencing homelessness. The hospital assured him that his care would be 100% covered by financial aid. However, the consumer continued to receive bills for $1,210. He attempted to correspond with the hospital regarding these bills but struggled with a language barrier. After OAG intervened, the hospital confirmed that full financial assistance would be applied to the consumer’s account. The hospital resolved the balance.

A consumer’s insurance company had approved two surgical procedures, including preoperative services, such as testing, office visits, and diagnostic imaging. Although the claims had been approved and paid, the consumer received a bill for $82,000. An OAG advocate wrote to the hospital, pointing out that the services had been preapproved as indicated in the patient’s explanation of benefits. The hospital then corrected the bill.

Many consumers complained to OAG about receiving bills for emergency department visits after they took a COVID-19 test at certain Northwell Health facilities. The OAG began an investigation and found that Northwell Health deceptively advertised three of its emergency departments as COVID-19 testing locations and then billed consumers for emergency-room visits. This included individuals who took a COVID-19 test at a drive-through testing location. Northwell’s practice involved billing for visiting an emergency room that was initially advertised as a COVID-19 testing location. This unlawful practice violated New York state consumer-protection laws. These laws prohibit deceptive acts or practices in the conduct of business, as well as false advertising. As a result of OAG’s investigation, Northwell Health refunded $400,000 to 2,048 consumers, improved its COVID-19 testing advertising practices, and paid a $650,000 penalty to the state.

The OAG received many consumer complaints about being billed for COVID-19 vaccinations at Northwell Health-GoHealth Urgent Care clinics. The OAG’s investigation revealed that 731 patients made out-of-pocket payments totaling $14,996 to satisfy vaccine charges. Northwell Health-GoHealth referred 72 unpaid accounts to collection agencies. This was an unlawful practice under the Centers for Disease Control’s (CDC) provider agreement regarding COVID-19 vaccine distribution. This provider agreement required providers to administer the COVID-19 vaccines at no out-of-pocket cost to the consumer. As a result of OAG’s investigation, Northwell Health-GoHealth must disclose and update its billing practices, withdraw accounts sent to collections, reimburse all wrongly charged consumers, and pay a $25,000 penalty.

This investigation arose from numerous consumer complaints about being unexpectedly billed by CareCube for COVID-19 tests. OAG’s investigation revealed that CareCube improperly charged patients when it was an in-network provider and the test should have been free. As a result of an investigation by OAG, CareCube must retain an auditor to identify all patients who were wrongfully charged so they can be refunded with interest and pay a $300,000 penalty.

Wrongful practices

These complaints include improper refund processes, improper collection activity, and general inefficiencies. In 2023, about 14 percent of all helpline complaints involved a wrongful practice. In 2024, that percentage increased significantly to approximately 19 percent.

A consumer had paid out of pocket for seven days of rehabilitation services. She later learned that her husband’s Medicare had also paid for the same services. The consumer contacted the facility, which repeatedly assured her she would be receiving a reimbursement check. She never received a check. She contacted the helpline. The OAG inquired about the reimbursement. The facility stated that it had mailed the check. The consumer then confirmed she had received the check.

A consumer had been unable to use her power wheelchair due to a dead battery. Her plan had approved coverage of a new battery. The durable-medical-equipment vendor supplying the battery did not schedule a delivery. Instead, the vendor asked the consumer to travel to their office for the battery installation — which she physically could not do. The consumer contacted the helpline. An OAG advocate was able to intervene and schedule a battery delivery and installation for the following week.

The helpline resolved the issue with no out-of-pocket cost. A consumer was balance-billed $1,100 by an out-of-network physician for an emergency room visit years earlier. The provider brought the consumer to court over the outstanding bill. The consumer told the helpline that his insurance company had said that he was responsible only for his $100 copay. The insurance company told him that the hospital had been paid. It turned out that the entity sending the bill was not the one that the insurance company had paid. As a result, the bill had gone ignored. An OAG advocate reviewed the insurance policy for protections against surprise billing. The insurance company sent the consumer a check for the full balance, so he could pay the provider with no out-of-pocket cost; and the court action was dismissed.

An insurance plan approved a prior authorization for a consumer’s new prosthetic leg. After the device was made, the insurance company denied 17 of 18 codes, asking for more documentation. The provider appealed the denial and resent documentation, but the consumer received no response to the appeal. The OAG inquired into the matter. The insurance plan admitted that the appeal had not been handled appropriately and overturned the denial. The consumer finally received his new prosthetic leg. The insurance plan also paid him prompt-payment interest, which is interest due because the payment was made and the device was delivered late.

A consumer was billed $125 that he had already paid to a laboratory by check. He contacted the lab multiple times about the issue and sent a copy of the cashed check from his bank. Despite his documentation, the lab continued to bill him. The lab eventually sent the balance to a debt collector. After OAG involvement, the lab located the payment, applied it to the consumer’s account, and withdrew the balance from collection.

Claim-processing and payment problems

These issues included health plan errors, such as a plan’s failure to pay claims, processing errors, payment of incorrect amounts, and deductible or copayment errors. In 2023, 13 percent of all helpline complaints related to claim processing or payment errors. That decreased to 12 percent in 2024.

A consumer complained because her health plan would not cover the removal of an abnormality during her preventive colonoscopy. The health plan claimed that the removal procedure was not part of preventive care or screening. The health plan denied coverage both initially and on appeal. The OAG became involved and asked the health plan to review regulatory guidance regarding insurance coverage for the prevention of colorectal cancer. The health plan reprocessed the claim, made additional payments to the provider, and removed cost-sharing for the consumer.

Health plan denials of coverage for care

Denials of coverage most often occur when an insurance company decides that recommended care is not medically necessary, even though a physician determined that the care is needed. These complaints often represent some of the most important and challenging issues the helpline handles. In 2023, approximately eight percent of all helpline complaints involved health plan denials of coverage. In 2024, that number increased to nine percent. These are both increases from our previous report, with seven percent of complaints in this category in 2022. In spite of a small annual increase for the last three years, the complaints in this category have generally declined since the three years prior to that, with 16 percent in 2019, 13 percent in 2020, and 10 percent in 2021.

The helpline received a complaint regarding the denial of coverage for an oral contraceptive under UnitedHealthcare’s Oxford plan. The OAG launched an investigation that uncovered that UnitedHealthcare required patients to take certain actions before obtaining birth control. These actions included prior authorization or step therapy, which is a process that requires patients to try alternative treatments. This requirement is unlawful under New York’s Comprehensive Contraceptive Coverage Act (CCCA). The CCCA requires health insurance plans to cover FDA-approved contraceptives without copays, restrictions, or delays. As a result of the investigation, UnitedHealthcare agreed to train all claims-approval staff on the law; reimburse all out-of-pocket costs plus interest to its members who overpaid for birth control; and ensure that all of its health plans are covering contraception without copays, restrictions, or delays. In addition, UnitedHealthcare is paying a penalty of $1 million.

A consumer with metastatic melanoma required a CT scan. The consumer’s health plan denied coverage of the scan because its medical-necessity guidelines allow only one CT scan every 12 months. However, the consumer’s oncologists stated that the current guidelines recommend a CT scan every six to 12 months. After an OAG advocate wrote to the health plan, the denial was overturned. The plan approved preauthorization of the CT scan.

A consumer went to the emergency room after being advised to do so by her urgent care doctor and her health plan’s own telemedicine provider. She was admitted to the closest hospital and underwent emergency surgery. Her insurance denied coverage. In its denial letter and explanation of benefits, the insurance company stated that the consumer owed $0. However, the hospital was outside the health plan’s network and not obligated to obey the health plan’s $0 patient responsibility. The health plan’s denial letter also indicated surgery was medically necessary ─ but at an outpatient level of care rather than at an inpatient level. The consumer was not able to control the level of care that she received. The OAG wrote to both the hospital and insurance plan and asked them to work together to facilitate a resolution. The health plan reached out to the hospital and submitted corrected claims. Discussions continued between the hospital and health plan. The health plan agreed to reprocess the claims. The hospital agreed to not balance-bill the consumer, who saved $49,189.

In a molar pregnancy, a fertilized egg develops into a nonviable mass of tissue rather than a fetus. A consumer required the removal of abnormal tissue from her uterus through dilation and evacuation ─ that is, an abortion procedure. The procedure was necessary to prevent serious complications, including cancer. Her health plan denied initial coverage and two subsequent appeals. This was because the plan covered abortion only where “carrying the fetus to full term would seriously endanger the life of the mother.” In this consumer’s case, the abnormal tissue was not a fetus and would not develop into a fetus. Her doctor had determined that it was medically necessary to remove the tissue to prevent serious health risks. After OAG intervened, the health plan reprocessed and paid the claims with no cost-sharing for the consumer.

A health plan denied a patient’s out-of-network residential mental health treatment as a noncovered service. The patient’s family paid more than $43,000 out of pocket for the patient’s care. The OAG advocate wrote to the health plan regarding the denial and requested the full policy, pointing out that under the contract, the treatment should have been covered. As a result, an agreement was reached with the provider and the claims were paid.

Obtaining and keeping coverage

In 2023, five percent of helpline complaints were about obtaining and keeping coverage. Of these, 28 percent turned out to be due to health plan error and 10 percent to employer error. In 2024, similarly, five percent of complaints fell into this category. Of these, 32 percent were due to health plan error and eight percent to employer error.

A consumer had paid for COBRA coverage prior to her employer-provided insurance coverage ending; however, her coverage remained inactive over one month later, when she contacted the helpline. After the OAG inquired, the health plan advised that her COBRA coverage had been terminated due to an employer error. The health plan agreed to create a new backdated policy to avoid any lapse in coverage.

A consumer obtained new health care coverage and paid the monthly premium in full but had not yet received ID cards for the plan. When she attempted to pick up her prescriptions, she was told to pay the uninsured out-of-pocket amount for her medications. Before contacting the helpline, she had contacted the insurer and received new member ID cards However, she appeared not to have insurance. An OAG advocate reached out to the insurer, who confirmed it had resolved an issue with the consumer’s group number. The pharmacy advised it would reimburse the consumer for any prescriptions paid out of pocket.

A consumer who was a cancer patient was terminated from his job. In its termination letter, his employer stated that his health insurance would expire at the end of the month. Thinking he still had insurance, he continued to receive care through the end of the month. However, the broker who handled his employer’s insurance benefits notified the insurance company that the coverage had terminated on the date the consumer was let go from his job. The plan denied coverage of the services. The consumer was not able to get the coverage restored and contacted the helpline. An OAG advocate explained to the health plan that the consumer had undergone the medical services in good faith. The consumer had a letter from his employer stating that his coverage would not expire until the last day of the month. It was not the consumer’s fault that the broker had given the plan the wrong date of termination. The insurance company responded, agreeing to restore coverage for the remaining portion of the month. The insurer processed the claims, and consumer saved $10,947 in medical bills.

Access to prescription drugs

These complaints included issues with formularies,* problems with mail-order drugs (including delays and non-deliveries), and denials of preauthorization for high-cost specialty drugs. In both 2023 and 2024, these complaints represented about three percent of all cases handled by the helpline. Compared with our last report, this is a decrease of about one percent from 2022, when four percent of complaints involved prescriptions.

*A formulary is a list of prescription drugs covered by a prescription drug plan or an insurance plan offering prescription drug benefits.

A consumer was due for immune globulin intravenous (IVIg) treatment for MS in a few days. Her three earlier claims for the IVlg treatment had been denied, despite having received prior authorization. Her provider would not purchase the $5,000 medication without first being reimbursed for the three prior treatments, totaling $15,000. The provider also sought a confirmation of preauthorization approval for another year. After OAG involvement, the plan confirmed approval of continuing IVlg treatment. The insurance company agreed to reprocess the incorrectly denied claims.

A consumer had been denied prior authorization for his insulin medication. Insurance representatives informed him that the information provided by his physician did not meet standards of coverage. An OAG advocate wrote to the insurance company and asked them to reach out to the provider for the necessary information. The insurance did so and approved a one-month authorization so the consumer could access the medication while the review was ongoing. The insurer then approved further coverage of the medication.

A consumer was told she had to pay for her fertility medications up front while the authorization process was taking place. Her plan told her that, once the prescription was approved, she could submit a claim for reimbursement. She used the pharmacy her plan told her to use. Her insurance extended its prior authorization for that specific pharmacy to retroactively include the date she obtained the medications. But, when the consumer submitted her claim, her insurance denied it, saying it would not cover out-of-network pharmacy claims. An OAG advocate wrote to the insurance company’s pharmacy benefit manager. They responded that a full refund of $3,675 had been issued to the consumer.

About OAG Health Care Bureau

The Health Care Bureau (HCB) is part of the Social Justice Division* in the Office of the New York State Attorney General. HCB’s principal mandate is to protect and advocate for the rights of health care consumers statewide through:

- Health care helpline. This toll-free helpline (800-428-9071) serves as a direct line between consumers and OAG. The helpline is staffed by intake specialists and advocates trained to assist New York health care consumers to protect consumers’ rights in the health care system. Assistance ranges from providing helpful information and referrals to investigation of individual complaints and mediation of disputes.

- In addition to calling the phone number, consumers can also receive helpline assistance by submitting a complaint form online. If you do not want to submit the complaint form online, you may call the HCB's toll-free helpline at 1-800-428-9071.

- Investigations and enforcement actions. HCB conducts investigations of, and litigates against, health plans, health care providers, and other individuals and business entities that engage in fraudulent, misleading, deceptive or illegal practices in the health care market. HCB also includes a specific section focused on tobacco compliance and enforcement. HCB has continued steadfast efforts to reduce tobacco consumption in New York State through monitoring compliance with, and enforcement of, the Tobacco Master Settlement Agreement. In addition, HCB is responsible for implementing and enforcing numerous state laws and policies. It is also responsible for enforcing certain federal laws relating to cigarettes.

- Consumer education. Through outreach and dissemination of information and materials, HCB keeps New Yorkers informed of their rights under state and federal health and consumer-protection laws.

- Legislation and policy initiatives. HCB promotes legislative and policy initiatives to enhance the rights and well-being of consumers and their ability to access high-quality and affordable health care in New York state.

*In addition to the Health Care Bureau, the Social Justice Division includes the following bureaus: Civil Rights, Labor, Environmental Protection, and Charities.

Conclusion

We at HCB, through our team of knowledgeable and dedicated advocates, attorneys, and support staff, remained active during 2023 and 2024, working to protect the rights of health care consumers in New York, and helping consumers navigate the complicated system of health care.

We encourage New Yorkers who need help with sorting out confusing medical bills, insurance claim denials by health plans, or fraudulent practices to contact the helpline. Our advocates work to resolve consumers’ problems when possible. Where there is no error or violation, we help consumers understand the health care system. We value consumer complaints, which lead to many of OAG’s investigations in the health care realm.

We thank the individuals who brought important matters to our attention in 2023 and 2024. We look forward in 2025 to bringing our skills and energy to champion the rights of consumers and enforce the laws and regulations governing the health care industry to ensure that health care consumers can access quality, affordable care in New York state.