Investment Guidance

Topics Covered

Smart Investing

The world of financial investment offers many opportunities and great rewards.

It sometimes can carry great risks.

By following these tips, consumers can protect themselves from some of the pitfalls of investing and avoid being scammed.

- Be wary of unsolicited phone calls and letters;

- Always demand written information -- and read it carefully;

- Be suspicious of "insider information," "hot tips," or "rumors;"

- Never be afraid to ask questions or tell someone that you don’t understand;

- Don’t give in to high-pressure sales tactics;

- Don’t believe promises of doubling or tripling your money in a short time;

- Deal only with established brokers;

- Check with the Attorney General’s Bureau of Investor Protection for information about brokers;

- Never rush in. Remember, when in doubt about an investment opportunity, it’s usually safer to wait.

Setting an Investment Goal

Investment goals will be influenced by your income and job security, your risk tolerance and your age. In addition, the time you have to achieve your goals should influence the kinds of investments you consider.

Ask questions such as:

- How much income do I need to meet fixed expenses?

- What are my long- and short-term goals?

- How much income do I need for other expenses?

- Am I just starting out, close to retirement, or somewhere in the middle?

- Do I have children to educate?

- What is my tolerance for risk?

- How much risk am I willing to take to achieve my goals?

Once you have determined your needs and tolerance for risk you are ready to take a look at different investments. Make sure that your risk tolerance and your investment strategy match. Investment goals can be:

For example, a vacation in Europe next summer.

Such a short time horizon suggests that the stock market wouldn't be a good place to invest the money you're setting aside for the trip. The market is subject to wide swings, and you wouldn't want to be forced to sell your stocks in a downswing just because the time had come to buy your airline tickets. Don't put into the stock market any money that you know you will need in the next two or three years. Low-risk vehicles such as certificates of deposit, for example, that mature about the time you'll need the cash, or a money-market fund that allows you to withdraw your cash instantly by writing a check, may be a better choice.

For example, a house within three or four years.

With more time, you have more flexibility. Safety is of course still a priority, but you are in a better position to ride out bad times in the financial markets and take on a little more risk. For medium-term goals like these, longer-term CDs that pay more interest than the short-term certificates that you would buy to help finance your vacation trip, or conservative mutual funds, may be appropriate.

For example, a comfortable retirement; a college education for your kids.

For long-term goals, the range of possibilities is somewhat wider: for example, stocks, corporate and government bonds, long-term CDs, mutual funds. You should also take maximum advantage of tax-sheltered plans, such as individual retirement accounts (IRAs) and 529 college savings plans. IRA earnings accumulate tax-deferred, and contributions may be tax-deductible. 401(k) plans provide many of the same advantages and might offer a company match that will help you reach your goal.

Your goals are likely to change, so it's important to reassess them at least annually. For instance, the kinds of growth-oriented investments that might be appropriate while you are accumulating a retirement nest egg and have a long-term horizon could be inappropriate after you retire and need income to pay the bills. There are many resources -- magazines, newspapers, books, the Internet, financial advisers -- that can help you decide how to modify your portfolio as your circumstances change.

Balancing Risk and Return to Meet Your Goals

Note these 3 Basic Rules

- Rule one: Risk and return go hand-in-hand. Higher returns mean greater risk, while lower returns promise greater safety.

- Rule two: No matter how you choose to invest your money, there will always be a degree of risk involved.

- Rule three: Do not invest in anything you do not fully understand.

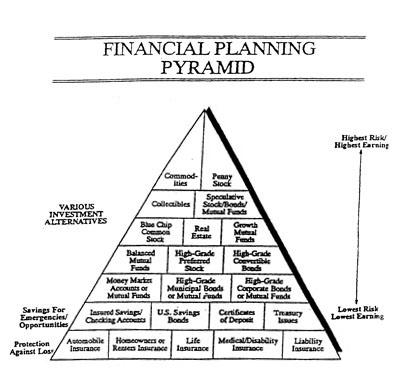

The pyramid is a useful visual image for a sensible risk-reducing strategy. It's built on a broad and solid base of financial security: a home; money in insured savings accounts or certificates; plus insurance policies to cover expenses if something should happen to your health, your car, your home, your life or your ability to earn an income. As you move up from the pyramid's base, the levels get narrower and narrower, representing the space in your portfolio that is available for investments that involve higher risk. The greater the risk of an investment, the higher up the pyramid it goes and, thus, the less money you should put into it.

At the very top of the pyramid go the investments that few people should try, such as penny or microcap stocks, commodity futures contracts, promissory notes and most limited partnerships. Most of these lend themselves to manipulation and fraud.

See a breakdown of the investments on the pyramid below.

How Much Risk Should You Take?

The risk-reward relationship applies no matter what the investment, who the investment adviser, what the condition of the financial markets or the phase of the moon.

Too many investors seem perfectly comfortable with entirely too much risk -- until the bottom falls out. The basic thing to remember about risk is that it increases as the potential return increases. Essentially, the bigger the risk, the bigger the potential payoff. Don't forget that there are no guarantees.

Does this mean you should avoid all high-risk investments? For most people, yes. For someone who wants to take a "high-risk flyer" (an investment in a theatrical production, for example), it means you should confine it to the top of the pyramid - never occupy a significant portion of your investment portfolio. Invest only as much as you can afford to lose because you might in fact lose it. You should also learn to recognize the risks involved in every kind of investment.

There Are Risks in Everything

Real Estate values go up and down in sync with supply and demand in local markets, regardless of the health of the national economy. Gold and silver, which are supposed to be stores of value in inflationary times, have not fulfilled this expectation. Even federally insured savings accounts carry risks -- that their low interest rate won't be enough to protect the value of your money from the combined effect of inflation and taxes.

What is a prudent risk?

It depends on your goals, your age, your income and other resources, and your current and future financial obligations. A young single person who expects his or her pay to rise steadily over the years and who has few family responsibilities can afford to take more chances than, say, a couple approaching retirement age. The young person has time to recover from market reversals; the older couple may not.

Basic Investment Concepts

Whether you make or lose money in the market depends on how your investments perform. That's what the risk in investing is all about. You can lose money because of the "downs" in the market, but you can also make money on the "ups."

Knowing how different products perform and the risks they represent can greatly increase your chances of choosing good investments. This means you need to take time to understand the various investment products. You need to understand their goals and risks.

Never invest in something you don't understand. Ask yourself "What is my objective?"

- Is it conservative, with safety of principal most important?

- Is it income-oriented, in which regular payments from the investment will be used for living expenses?

- Are you investing for long-term growth, which may carry more risk than either income or safety?

- Are you comfortable with a higher risk in hopes of higher gain, or is some mix of these objectives right for you?

The following investment objectives, or some combination of them, can provide an answer.

- Safety is a conservative investment goal that carries minimal risk of loss of principal.

- Income reflects an investment goal that provides income through regular payments to the investor.

- Growth investments are for long-term investing. Growth investments usually carry a higher risk than either safety or income investments.

- Speculation is the riskiest investment. With the high risk usually comes the possibility of higher gains.

If you want your investments to compound more quickly, you don't have to take more risks. What you can do is put money into tax-deferred investments, including individual retirement accounts (IRAs) and salary reduction retirement plans like 401(k)s or Keoghs.

In most cases, there's a cap, or limit, on the amount you can invest tax-deferred each year. Experts advise you to take the fullest advantage you can of this opportunity.

There are drawbacks to tax-deferred investing. Generally, you'll have to pay a penalty as well as whatever tax is due -- if you withdraw money from tax-deferred accounts before you reach 59 1/2. And you usually must take mandatory withdrawals and pay the tax that's due beginning at age 70 1/2.

If you're worried about having enough money when you retire, tax-deferred investing may be the best way to meet your goals. And there are situations when the withdrawal penalty is waived, including serious illness, paying college tuition or putting money down on the purchase of your first home.

Additional Considerations

Always set aside some of your money for emergencies before you invest. Ask for advice from a trained and licensed professional.

- Be selective in your investment choices. Exercise your right to say "No."

- Ask about all fees and charges related to your investment choices prior to purchase. Fees reduce your rate of return; it may take a year or more to recover such fees.

- Develop a sensible investment plan and follow it.

- Judge each company on its own merits. Do not invest in a company just because it is part of a fast growing and successful industry.

- Never invest based on information obtained from an unsolicited telephone call or based on a "hot tip".

- Check the credentials of anyone you do not know who offers to sell you an investment.

- After you develop a sensible investment plan, stick with it.

How to Choose an Investment; Pyramid of Investment Risk

When you choose to invest your money, the final decision is yours alone. The risk of the investment is also yours.

Points to Consider Before You Invest

- What is the prospective yield?

- What is the return you hope to achieve?

- What is the risk?

- Can the investment easily be sold or converted to cash? Is there a charge to do so?

Insured savings account

Available through banks, savings and loan associations, and other financial institutions; insured by FDIC, a government agency; considered safe and convenient; associated with checking alternatives such as NOW accounts.

U.S. savings bonds (EE or HH)

Available through many financial institutions and payroll-deduction plans; provide an opportunity for you to invest in the U.S. government by buying a bond with a set maturity date at a price below face value.

Certificate of deposit

Savings certificates in a specific amount of money for a specific length of time, and with a specific rate of interest; one main feature is convenience.

Treasury issues

Bills, notes, or bonds, in denominations of $1,000 to $1 million; mature from 30 days to more than five years after issued by the Treasury Department.

Bonds

Certificates of debt; issued by corporations or government agencies that promise payment of interest on specific dates, with payment of the original investment amount at maturity.

Mutual Funds

Diversified investment alternative; for individual investors to pool dollars that are professionally managed, to meet various investment objectives.

Stock

Investment that represents a share of ownership in a company; value of the stock may increase or decrease, based on the success, or perceived success, of the corporation.

Collectibles

May be coins, stamps, artwork, baseball cards, or other items that can be bought, held, and sold, depending on supply and demand.

Commodities

Gold, silver, other precious metals, and even food and wood that can be purchased in contract form to speculate on future world demands, or to "hedge” against present investments.

While, the most common types of investments or "securities" are stocks, bonds and mutual funds, securities can also include: futures and options, real estate investment trusts, promissory notes, limited partnerships, oil and gas leases and investment contracts.

The investment alternatives listed above are ranked in descending order of the relative safety of these investments -- from low-risk at the top to higher risk at the bottom. Another way of looking at this is to turn the list upside down and imagine it as a pyramid.