Attorney General James Releases Top 10 Consumer Complaints of 2023

Top Frauds Included Retail, Housing Issues, Automobile, Banking and Credit, and Consumer Services

AG James Offers Tips to Avoid Scams, Urges New Yorkers to Report Fraud to her Office

NEW YORK – New York Attorney General Letitia James kicked off National Consumer Protection Week by releasing a list of the top 10 consumer complaints received by the Office of the Attorney General (OAG) in 2023. The top complaints range from price gouging of essential goods and services to housing issues, online banking fraud, and travel related issues. Attorney General James also provides a variety of tips on how consumers can avoid common scams.

“With families struggling to make ends meet, consumers expect and deserve quality products and services for their hard-earned money,” said Attorney General James. “As Attorney General, I take my responsibility to stand up for New York consumers against fraud and abuse as a top priority. When New Yorkers raise concerns and file complaints with my office, we take action and work to hold bad actors accountable. As always, I urge New Yorkers to stay vigilant, and to keep my office informed about scams and violations of consumer protection laws.”

During 2023, Attorney General James took historic actions to protect New York consumers, address complaints, hold bad actors accountable, and ensure New York laws were upheld. Attorney General James successfully defended New York’s Rent Stabilization Laws. Additionally, Attorney General James protected homeowners and tenants from discrimination, deed theft, fraud, lead contamination, and abuse. Attorney General James proposed rules to protect consumers and small businesses from corporate profiteering and strengthen New York’s price gouging law, and also issued consumer alerts warning against price gouging during states of emergency. Attorney General James sued Credit Acceptance Corporation (CAC), one of the nation’s largest subprime auto lenders, for deceiving thousands of low-income New Yorkers into high-interest car loans. Additionally, Attorney General James and a coalition of 17 other attorneys general called for a national recall of unsafe Hyundai and Kia vehicles and issued a consumer alert to protect New Yorkers from car thefts. To protect New York consumers against identity theft, Attorney General James held companies accountable for data breaches, and provided a guide on how to better protect New Yorkers’ personal information. Attorney General James also sued SiriusXM radio for trapping consumers in subscriptions and maintaining deliberately long and burdensome cancellation processes.

Attorney General James urges New York consumers who have been the victim of deceptive or fraudulent practices to file a consumer complaint online.

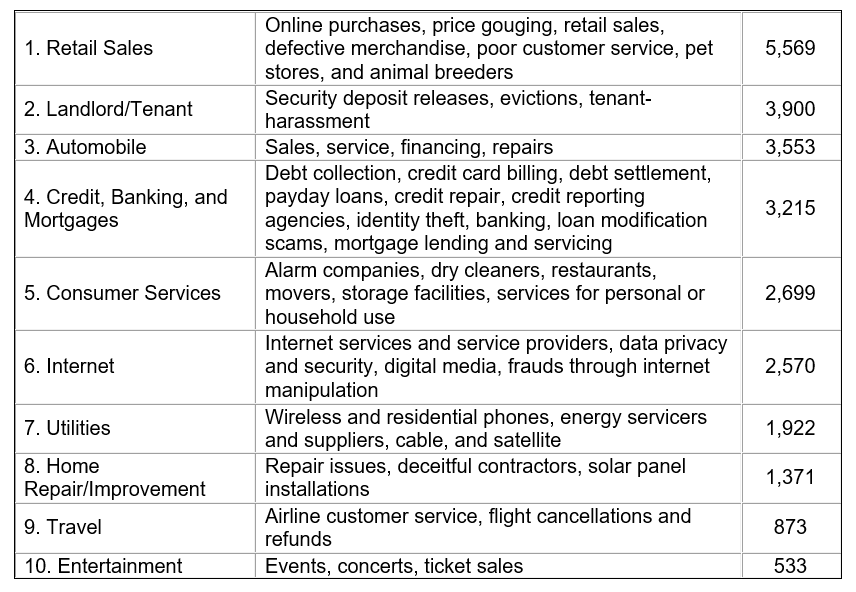

The following are the top 10 most common types of consumer complaints received by OAG in 2023 by category:

- Online and In-Person Purchases (Retail Sales):

- Be aware of scammers that operate on online marketplaces. Before you buy from a seller listed on a marketplace, check out the individual seller’s history for their rating and any complaints or negative reviews. Also check the seller’s shipping fees and refund and return policies. Always use safe payment methods like a credit card. Never pay with wire transfers, gift cards, or cash reload cards. Finally, don’t buy from any seller who wants you to pay outside the marketplace’s payment system.

- Consumers should pay close attention to the prices charged on goods and services following any major weather event or other abnormal market disruptions. New York law prohibits businesses from taking unfair advantage of consumers by selling goods or services that are vital to health, safety, or welfare for an unconscionably excessive price during emergencies. New Yorkers should report price gouging to OAG by filing a complaint online or calling 800-771-7755. When reporting price gouging, consumers should provide the dates and places that they saw the increased prices, copies of their sales receipts, and any photos of the advertised prices.

- Landlord/Tenant

- Your landlord must return your security deposit within 14 days of you moving out. If your landlord takes any money out of the security deposit for damages, they must provide an itemized receipt describing the damage and its cost. If your landlord doesn’t give you this receipt within 14 days of moving out, then they must return your entire security deposit, whether there is damage or not. If your landlord fails to comply, you may be entitled to up to twice the amount of the security deposit. If your landlord does not give you back your security deposit, you can sue the landlord in small claims court or you can file a complaint with the New York Attorney General by using the online Rent Security Complaint form.

- Landlords of buildings with six or more units must deposit a tenant’s security deposit into an interest-bearing account in a bank within the state that pays a prevailing rate. The landlord is required to provide notice to the tenant of the name and address of the bank where the security deposit is located. If you do not have this information or if your landlord is not placing your security deposit in an interest-bearing account, you can file a complaint with OAG by using the online Rent Security Complaint form.

- You should find out whether you are in a rent-stabilized apartment and thus are entitled to one- or two-year renewal leases at your option and at percentage increases that are established each year by the Rent Guidelines Board. You can find out if your apartment is rent stabilized by filing out this form on New York State’s Housing and Community Renewal’s (HCR) website and selecting “Apartment Rent History.” From the rent history, you should be able to determine if the rent went up in accordance with the rent stabilization guidelines. If it has not, and you believe you are being overcharged on the rent, you can file an RA-89 Form with HCR.

- Avoid signing back-dated documents from your landlord or the building management company, such as back-dated leases that were not offered to you in a timely way. Not only is signing a back-dated document inaccurate, it may also result in negative legal consequences down the road.

- If you are having trouble paying your rent, please contact your local Department of Social Services (DSS). Check DSS’ website to find their offices across the state. New York City residents can call 311 and ask about rental assistance programs. More resources are available on the OAG website.

- Automobile

- OAG has seen an increase in complaints about thefts targeting vehicles made by Hyundai and Kia. Attorney General James has previously urged Hyundai and Kia to fix safety flaws, such as faulty ignition switches and a lack of engine immobilizers, that have made their vehicles manufactured between 2011 and 2022 vulnerable to thefts. New Yorkers who own Hyundai and Kia vehicles manufactured between 2011 and 2022 should take the following steps to protect themselves against theft:

- If you’re a Kia owner or lessee, you should check Kia’s website or call Kia directly to check the status of your vehicle’s eligibility for a software upgrade or free steering wheel lock. You can contact Kia’s Customer Care team toll-free at 1-800-333-4542 or online via its Owners Portal.

- If you’re a Hyundai owner or lessee, you should check Hyundai’s website or call Hyundai directly to check the status of your vehicle’s eligibility for a software upgrade or free steering wheel lock. You can call Hyundai’s customer care agents toll-free at 1-888-498-0390 or visit its website for more information.

- Contact your Hyundai/Kia dealer to ask about having the software on your vehicle upgraded to repair the vulnerabilities that make the vehicles uniquely prone to car theft.

- Request an anti-theft steering wheel device from Hyundai or Kia if your vehicle is not immediately eligible for a software patch that would repair its vulnerabilities.

- Check your mail regularly and be aware of any notices from Hyundai, Kia, or government agencies regarding any mandatory or voluntary recalls of vehicles or additional safety measures that may become available for your vehicle.

- OAG has seen an increase in complaints about thefts targeting vehicles made by Hyundai and Kia. Attorney General James has previously urged Hyundai and Kia to fix safety flaws, such as faulty ignition switches and a lack of engine immobilizers, that have made their vehicles manufactured between 2011 and 2022 vulnerable to thefts. New Yorkers who own Hyundai and Kia vehicles manufactured between 2011 and 2022 should take the following steps to protect themselves against theft:

- Credit, Banking, and Mortgages

- OAG continues to receive reports of scammers attempting to steal consumers’ hard-earned wages, crucial benefits, and life savings. Common scams include attempts to convince consumers to send money electronically or through purchases of Amazon cards, Apple gift cards, or Google Pay cards, as well as efforts to pose as representatives of banks, government agencies, or other trusted entities to obtain consumers’ personal or security information to access their accounts and steal their money. The OAG reminds consumers: (i) never send money to unknown parties by electronic means or through purchases of online cards or cryptocurrency, particularly in response to unsolicited or unexpected phone calls; (ii) your bank will never ask for your security information over the phone; (iii) if you ever have any doubts about who you are speaking with on the phone, hang up and call a trusted number, such as the one on the back of your debit card; and (iv) if you believe you’ve been a victim of a scam, contact your bank immediately and file a complaint with OAG.

- “Junk fees” are unnecessary, unavoidable, or surprise charges that increase the cost of a good or service while adding little to no value for that good or service. These fees may include overdraft fees (fees charged for overdrawing on an account), bounced check fees, and fees charged to make a mortgage payment online or through the phone (also known as pay-to-pay fees). If you believe these fees have been wrongly imposed, you should call the company and dispute them. You should also file a complaint with OAG.

- Certain payment providers, including app-based banking and payment services, may be making it difficult for consumers to report unauthorized transactions using their financial and payment apps or otherwise not honoring their legal obligations to investigate and reimburse unauthorized transactions. The OAG urges consumers who have been the victim of unauthorized or fraudulent activity on their accounts — including bank accounts, financial accounts, and payment apps — to immediately notify their providers of such activity and to file a complaint with OAG if providers fail to reimburse losses.

- OAG has seen an increase in foreclosure lawsuits being filed on “zombie second mortgages,” mortgages where the homeowner has not made a payment or heard anything about the mortgage for years. Under New York law, mortgage companies generally can only collect on the last six years of missed mortgage payments; seeking to collect beyond that may be illegal. Please contact the New York State Homeowner Protection Program (HOPP), which includes free legal services attorneys, by visiting their website or calling (855) HOME-456.

- Homeowners who need a mortgage modification, or are looking to refinance their current mortgage, should work with a HUD-approved, nonprofit housing counselor to assess their options. Please contact the New York State Homeowner Protection Program (HOPP), which includes free HUD-approved housing counseling, by visiting HOPP’s website or calling (855) HOME-456.

- Hard money lenders have begun targeting vulnerable homeowners who are afraid of losing their home to foreclosure. Hard money loans are based solely on the value of the property securing the loan, and do not rely on underwriting to determine if the payment is affordable to the borrower. They often have extremely high interest rates and short repayment terms. Hard money lenders often require homeowners to transfer their property to a limited liability corporation or other corporate form in order to obtain the loan. If you are approached by a hard money lender, use extreme caution and report any suspicious offers to OAG.

- Consumer Services

- OAG continues to receive reports of mail theft, especially checks, credit cards, and other financial documents, being stolen from mailboxes. Mail theft is a federal crime and can lead to identity theft, deed theft, and serious invasions of financial and personal privacy that harm New Yorkers. As part of her ongoing efforts to combat theft and protect New Yorkers, Attorney General James recommends the following tips from US Postal Services:

- Always pick up your mail promptly when delivered. Do not leave it in your mailbox overnight. If you are expecting checks, credit cards, or any other financial items, ask a trusted friend or neighbor to pick up your mail.

- If you did not receive a check or any other valuable mail you were expecting, contact the issuing agency immediately.

- If you change your address, you should immediately notify your respective post office and anyone with whom you do business with via mail.

- Inform your post office when you’ll be out of town, so they can hold your mail until you return.

- Consider signing up for USPS’ Informed Delivery service, which provides email notifications for incoming mail and packages.

- If you suspect your mail was stolen or see a mail theft happening, contact police immediately and then report it to Postal Inspectors by calling (877) 876-2455.

- If you see glue, tape, or any other sticky substances on a mailbox, report it to your post office, Postal Inspectors, or the New York Division of the U.S. Postal Inspection Service (USPIS). The USPIS can be reached at (212) 330-2400.

- OAG continues to receive reports of mail theft, especially checks, credit cards, and other financial documents, being stolen from mailboxes. Mail theft is a federal crime and can lead to identity theft, deed theft, and serious invasions of financial and personal privacy that harm New Yorkers. As part of her ongoing efforts to combat theft and protect New Yorkers, Attorney General James recommends the following tips from US Postal Services:

- Internet

- OAG is seeing an increase in complaints related to account takeovers. In an account takeover, threat actors compromise your account (such as Facebook or Instagram) and change passwords so that the rightful owner cannot access the account. Once threat actors gain access, they can usurp personal information, read private messages, scam contacts, post publicly, fraudulently charge credit cards, and take other nefarious actions. Consumers should consider the following to help protect themselves:

- Strong Passwords: it is important to have a strong and unique password for each of your online accounts. The password does not need to be long but has to be complicated enough, utilizing a combination of letters, numbers, and special characters.

- Multifactor Authentication: enable multifactor authentication, when possible, on your accounts. Multifactor authentication provides an extra level of security when signing into an account.

- Notification of Account Changes: enable notification of account changes in real time. This will alert the user to any changes such as password updates or login attempts, allowing the user to take prompt action if the changes were not authorized.

- Antivirus Software: make sure your antivirus software is up to date with the latest virus definitions. Maintain a routine of running your antivirus software periodically to catch any malware, such as a keylogger, on the computer.

- Check Breached Credentials Database: check websites, such as https://haveibeenpwned.com/, to monitor which accounts of yours have suffered a data breach incident. Knowing which accounts have been compromised can help you take corrective actions, such as changing your passwords, as soon as possible.

- OAG is seeing an increase in complaints related to account takeovers. In an account takeover, threat actors compromise your account (such as Facebook or Instagram) and change passwords so that the rightful owner cannot access the account. Once threat actors gain access, they can usurp personal information, read private messages, scam contacts, post publicly, fraudulently charge credit cards, and take other nefarious actions. Consumers should consider the following to help protect themselves:

- Utilities

- Know your rights: A new law requires utilities to bill residential and commercial customers no more than three months after the service is used, with utilities having no right to ask for payment after that period, unless the billing delay was the consumer’s fault.

- New Yorkers recently saw considerable and sudden increases in their gas and electric bills. Any consumer who believes they received a high utility bill as a result of a billing error should report it to OAG by filing a complaint online or calling 800-771-7755. If you have trouble paying your energy bill, contact the utility company. Resources are available for consumers who may need help paying their utility bill. Utility companies offer programs and payment plans to help. In addition, the Home Energy Assistance Program (HEAP) helps low-income individuals pay the cost of heating their homes. Information on how to apply is available at https://otda.ny.gov/programs/heap/

- Home Improvement

- Like many New Yorkers, you may be faced with making major repairs to your property after a major storm or other weather event. Greater demand for contractors may make it harder for you to find a reputable contractor to make badly needed repairs. Some contractors may overextend themselves and promise more than they can deliver. Natural disasters and major weather events often attract scam artists who try to take advantage of you and other consumers when you are most vulnerable. After a big weather event, be especially vigilant to avoid being victimized as you attempt to put your life back in order. Here are some helpful tips:

- Be wary of anyone who shows up at your door unsolicited and offers to do home repairs.

- Non-local contractors may be difficult to track down if they perform work incorrectly, or if you later have additional problems you want the contractor to fix.

- Use a contractor with a name, address, and contact number you can verify.

- Don’t fall prey to high-pressure tactics. A legitimate contractor won’t pressure you to sign a contract and hand over a deposit on the spot.

- Never give a contractor a cash deposit before you sign a contract.

- Always do your homework before you hire a contractor:

- Ask for references and follow up by checking with them.

- Ask the contractor for proof of insurance.

- Check the Better Business Bureau website for complaints.

- Search online for any evidence that the contractor is disreputable.

- Home-improvement contractors must be licensed in New York City, Suffolk, Nassau, Westchester, Putnam, and Rockland counties, and the city of Buffalo. Before you hire a contractor, check to make sure the contractor is licensed or registered in your county.

- Like many New Yorkers, you may be faced with making major repairs to your property after a major storm or other weather event. Greater demand for contractors may make it harder for you to find a reputable contractor to make badly needed repairs. Some contractors may overextend themselves and promise more than they can deliver. Natural disasters and major weather events often attract scam artists who try to take advantage of you and other consumers when you are most vulnerable. After a big weather event, be especially vigilant to avoid being victimized as you attempt to put your life back in order. Here are some helpful tips:

- Travel

- Be cautious about paying in full for trips well in advance of your departure date. Some companies offer appealing discounts if you do this, but they then hold your money and could have trouble repaying you if the trip is canceled, or if the company changes the dates or locations to ones that don’t work for you.

- Travel insurance: If you choose to buy trip insurance, make sure you know who you are buying from. Some travel companies make it sound like you can buy travel insurance through them, but in fact they are using a travel insurance company to administer any claims the travel company receives. The travel company itself is paying the claims and the travel insurance company won’t be responsible if the travel company can’t pay. Make sure you understand what you are paying for: some travel insurance policies only cover the trip once you get to your departure destination, such as a port in Europe where an ocean liner or riverboat will depart. Not covered in those policies are your airfare to get to Europe, hotels there while you’re waiting to depart on your trip, and any upgrades you may have purchased.

- Entertainment

- Purchasing tickets online is a convenient way for sports fans, theater lovers, and concert goers to get tickets to their favorite events, but there are risks involved with buying tickets online. Here are some tips to avoid being scammed:

- Purchase tickets directly from the event organizer or an authorized ticket reseller. Be aware of scammers that set up fake websites. Carefully check the website’s URL to make sure it is a legitimate, authorized reseller and not a spoofed website. Check for the lock symbol in the website’s address which indicates it has enhanced security and encryption in place.

- Avoid purchasing tickets from individual sellers on social media or unauthorized ticket resellers. Never pay using mobile banking apps, debit cards, gift cards, or cash. Use only protected payment methods such as a credit card or an online payment system that won’t disclose your credit card or banking information.

- If the event is cancelled, contact the venue or reseller for information about a refund. In New York state, ticket sellers are required to refund the cost of the ticket if the event is cancelled. This applies only to event cancellations, so find out from the seller what their policy is if the event is postponed.

- Purchasing tickets online is a convenient way for sports fans, theater lovers, and concert goers to get tickets to their favorite events, but there are risks involved with buying tickets online. Here are some tips to avoid being scammed: