Attorney General James Sues Payday Lending Companies for Exploiting Workers with Illegal Loans

MoneyLion and DailyPay Pushed Tens of Thousands of New Yorkers into Short-Term, Expensive Payday Loans

AG’s Investigation Found Lenders Charged Outrageous Interest and Took Hundreds of Dollars from Workers’ Wages through Abusive Lending Schemes

NEW YORK – New York Attorney General Letitia James today sued payday lenders MoneyLion Inc. (MoneyLion) and DailyPay, Inc. (DailyPay) for taking advantage of tens of thousands of New Yorkers with illegal high-interest loans. Both MoneyLion and DailyPay make paycheck advance loans to hourly workers in exchange for fees and tips, pretending to simply be advancing “earned” wages. Due to the short terms of the loans, the fees MoneyLion and DailyPay charge amount to outrageous annual interest rates in the triple digits, frequently up to 750 percent. Both payday lenders also engage in abusive tactics that push workers to frequently take out new loans to cover gaps created by their prior loans. With these lawsuits, Attorney General James is seeking to end MoneyLion and DailyPay’s illegal payday lending practices in New York, obtain restitution for tens of thousands of impacted workers, and impose civil penalties.

“Promising New Yorkers financial freedom while pushing them into outrageously expensive loans is downright shameful. These are payday loans by another name,” said Attorney General James. “While many New Yorkers are worried about making ends meet, DailyPay and MoneyLion are making tremendous profits by extracting workers’ hard-earned wages. I’m suing DailyPay and MoneyLion because New Yorkers deserve to keep the money they earn, not have it taken by predatory lenders.”

In a typical transaction with DailyPay or MoneyLion, a worker receives a small amount in advance of their paycheck – usually less than $100 – and repays that amount, plus fees and tips, in seven to ten days. The result is an extremely high annualized interest rate ranging between 200 percent and 350 percent on average, but rates for these short-term loans can reach much higher. For example, DailyPay’s most common loan, a seven-day $20 paycheck advance offered for $2.99 actually reflects an annual interest rate of over 750 percent. More than half of all MoneyLion loans impose annual interest rates above 500 percent.

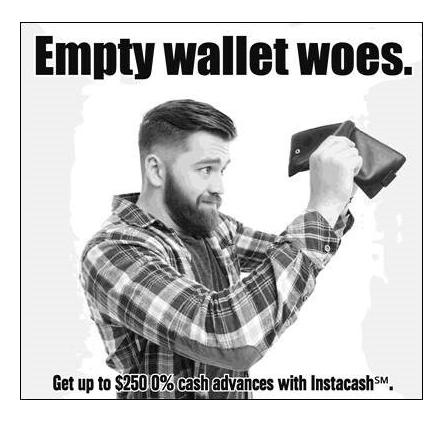

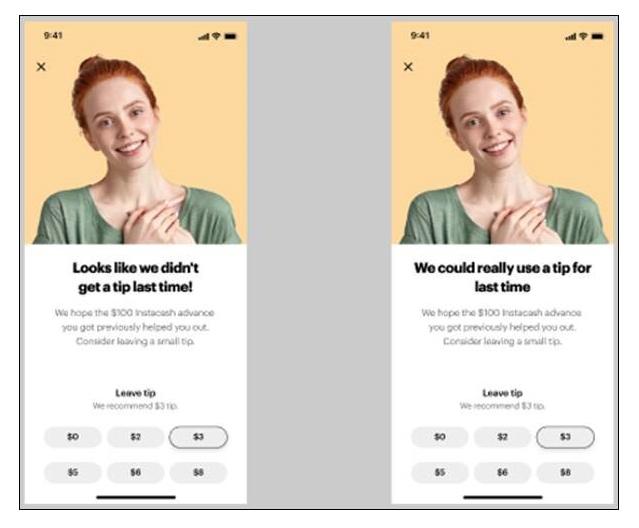

Attorney General James alleges that both companies employ deceptive advertising to entice workers into taking out their exploitative loans. MoneyLion promises instant access to funds, a zero percent interest rate, and a fee-free product. In reality, it charges mandatory fees for all loans where funds are immediately available, which can be as high as $8.99 for a $100 advance scheduled to be repaid in two weeks from the time the loan is issued. This reflects an annual interest rate of 234 percent. To extract even more money from its customers, MoneyLion asks for tips on top of its fees and sets an artificial limit of $100 per transaction that forces workers to take out repeat loans and pay repeat fees merely to receive the $500 they are prominently promised in MoneyLion’s advertisements.

DailyPay engages in similar fraudulent and deceptive practices. It contracts with employees’ companies, requiring employers to send their workers’ paychecks directly to the lenders first on payday, which allows it to deduct all amounts it is owed before passing on any remaining balance to employees. While it promises workers interest-free advances and financial benefits, DailyPay collects fees on about 90 percent of its loans.

These payday loans are enormously costly for workers and require many to take out repeated loans to be able to make ends meet. One worker in Washington Heights, for example, took out more than 450 loans from DailyPay in less than two years, averaging more than 4.5 loans per week and paying nearly $1,400 in fees. Another worker in Syracuse paid fees on all but two of the nearly 500 loans he took out with DailyPay, paying an average of $2 to DailyPay every single day for nearly two years.

The abusive nature of its business is a selling point for DailyPay: it touts its customers’ dependency to potential investors, claiming the company can extract hundreds of dollars in wages on average each year from an hourly worker. While DailyPay markets itself as a means to financial freedom, it uses its access to workers’ paychecks to ensure it always gets paid back first, regardless of the harm caused to workers’ financial wellbeing.

Attorney General James alleges that these two companies’ practices constitute illegal and deceptive conduct and abusive lending practices that violate New York’s longstanding usury prohibitions. The lawsuit against DailyPay also alleges the company has violated New York’s wage assignment laws. The lawsuits seek to end both companies’ technology-assisted payday lending practices in New York, obtain restitution for tens of thousands of workers, and impose civil penalties and costs.

These matters are being handled by Assistant Attorney General Chris Filburn of the Consumer Frauds and Protection Bureau, with the assistance of Data Scientist Akram Hasanov and Data Analyst Casey Marescot, both of the Research and Analytics Department. The Consumer Frauds and Protection Bureau is led by Bureau Chief Jane M. Azia and Deputy Bureau Chief Laura J. Levine, and is part of the Division of Economic Justice, which is overseen by Chief Deputy Attorney General Chris D’Angelo and First Deputy Attorney General Jennifer Levy. The Research and Analytics Department is led by Director Victoria Khan and is also overseen by First Deputy Attorney General Jennifer Levy.