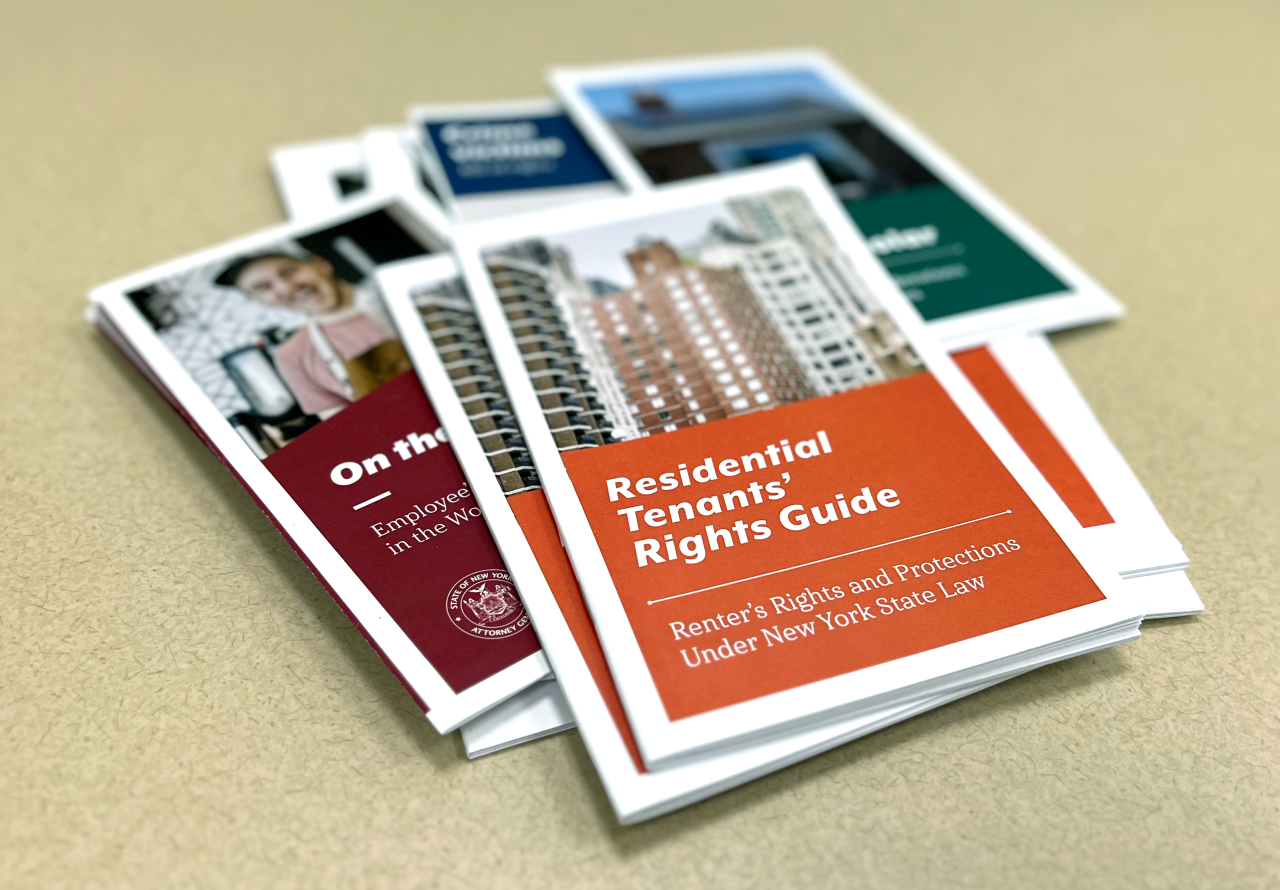

Publications Library

The Office of the New York State Attorney General offers informational publications on a variety of issues important to New Yorkers.

Additional languages

Search by topic

Popular publications

Tenants' rights

Learn about leases, rent, livability, safety, utility services, and tenants' personal protections (not including co-op or condominium housing).

Smart seniors

We offer guidance to help senior citizens better understand how to protect themselves against scams, threats to their health, and elder abuse.

Autos

Lemon law brochure

If your new or used car does not meet its warranty requirements, New York’s “lemon laws” may provide a legal remedy.

View publication

Used car lemon law

If your used car does not meet its warranty requirements, New York’s “lemon laws” may provide a legal remedy.

View publication

Buying a car

Get tips on researching vehicles, choosing a dealer, and knowing what to look for in a contract.

View publication

Charities

Joint Statement from 12 Attorneys General

President Trump is Misleading the American People on Purpose of Diversity, Equity, Inclusion, and Accessibility Initiatives.

View publication

Dissolution of not-for-profit corporations with assets

Use our guidance and checklists for dissolving your corporation and disposing of assets.

View publication

Dissolution of not-for-profit corporations without assets

We offer guidance, checklists, and forms to help you dissolve your corporation.

View publication

Donating to charity safely and wisely

Read our advice on donating safely and wisely. Ensure your donation goes as far as it can.

View publication

Forming and changing not-for-profit corporations

View publication

Guidance for tax-exempt organizations on political activity and lobbying

Understand the prohibitions against political and election-related activities by certain tax-exempt organizations.

View publication

Houses of worship for lease or sale: congregants' guide

Know your rights. You may have voting rights regarding the sale, lease, or mortgage of your organization.

View publication

Hiring a professional fundraiser tips

Ensure that your fundraiser is reputable, honest, and fair, and won't charge more than you can afford.

View publication

Multistate guidance for private entities holding charitable scholarship funds

This memorandum includes guidance to the philanthropic community on navigating directives from donors to fund scholarships and grants for racial minorities and other protected classes.

View publication

Diversity, Equity, Inclusion, and Accessibility Employment Initiatives

Multi-State Guidance helping businesses, nonprofits, and other organization operations.

View publication

Internal controls for not-for-profit boards

Protect your assets, improve your reporting, help you comply with laws, and have efficient operations.

View publication

Management of endowment funds for charities

Use our guidance on managing investing funds for your not-for-profit organization.

View publication

Mergers and consolidations of not-for-profits

Learn about required approvals registration, and petitions. Understand how to form a plan.

View publication

Not-for-profit corporations: directors' responsibilities

Our guidance helps you understand and carry out your fiduciary duties to your organization.

View publication

Religious corporations: disposition of assets

Ensure that your house of worship follows the laws and correct procedures for disposing of assets.

View publication

Sales and other dispositions of assets

Our guidance, checklists, and tips help you comply with laws and accomplish a successful transaction.

View publication

Civil rights

Employment discrimination

Workplace discrimination is illegal. Learn what to do if you experience or witness it.

View publication

Equal pay

Learn your rights and get helpful resources to ensure that you are paid fairly and equitably.

View publication

Fair housing

Learn about laws concerning discrimination in the rental, sale, or financing of homes.

View publication

Human trafficking

Identify the signs of human trafficking. Find help for yourself or anyone victimized by this crime.

View publication

Immigration services fraud

Immigrants have rights under the law. Use our tips to avoid scams that target you.

View publication

LGBTQIA+ rights

It is illegal for anyone to harass or discriminate against you because of your sex, gender identity or expression, sexual orientation, or HIV/AIDS status or other disability.

View publication

Language access

No matter your primary language or hearing impairment, you have a legal right to information and services.

View publication

Marijuana legalization and record expungement

Get detailed instructions on expunging marijuana-related convictions from your criminal record.

View publication

Religious rights in the workplace

Learn the rights and responsibilities of workers and employers for accommodating religious needs.

View publication

Service animals

Laws protect people who rely upon service animals, particularly in public accommodations and housing.

View publication

Sexual harassment in the workplace

Learn about sexual harassment, the steps you can take, and what to do about retaliation for a harassment complaint.

View publication

Source-of-income discrimination

In some areas, landlords cannot discriminate against you if your income does not come from wages.

View publication

Consumers

After the storm

Get tips for dealing with repair contractors and avoiding price gouging after natural disasters.

View publication

Debt: Managing the overload

Learn about dealing with debt collectors and seeking help from credit-counseling agencies.

View publication

Deed theft

Avoid deed theft and similar scams and keep possession of your home.

View publication

e-Bike safety

Your e-bike is valuable to you and helps you do your job. Protect yourself with our tips.

View publication

Hiring a home-improvement contractor

Learn about hiring a home-improvement contractor, avoiding scams, and getting your money's worth.

View publication

Identity theft kit

Here are immediate steps to take if your identity or other personal information has been stolen.

View publication

IRS scams

Avoid being scammed by con artists pretending to represent the Internal Revenue Service.

View publication

Low-cost banking

Find low-cost services that banks must provide consumers, plus other options like prepaid debit cards.

View publication

Payday loans

Read about payday and other types of short-term, high-interest loans. Learn to stay out of debt and avoid scams.

View publication

Phone scams

Scammers use both live and robo calls to trick victims. Here are tips on how to avoid the scam.

View publication

Protect your identity

Learn what identity theft is and how it works. Get tips for protecting your information and credit.

View publication

Savvy consumers

Use our tips on making smart purchases, not getting cheated, and avoiding bad deals.

View publication

Summer scams

Warm weather can bring out the scammers. Here is how to spot some common scams.

View publication

Crime and safety

Crime victims' bill of rights

Victims' rights include the right to know, involvement, protection, help, and reparations.

View publication

Environment

Fighting climate change on the road

Get tips on fighting climate change and pollution generated by transportation and fossil fuels.

View publication

Lead paint poisoning

Avoid and test for lead paint poisoning. Know your rights when renting, owning, and improving your home.

View publication

Mold in your home

Find out how to remove mold from your home after storms and flooding.

View publication

Solar tips for homeowners

Interested in solar panels? Here are some common options and issues to consider.

View publication

Health

Abortion rights in New York

New York protects the abortion rights of everyone, including transgender and nonbinary people.

View publication

Advance directives

Learn about end-of-life health care, including advance directives, pain management, hospice care, and organ donation.

View publication

Health care helpline

Our Health Care Bureau safeguards your health care rights, mediates disagreements, provides resources, and investigates fraud and abuse.

View publication

Health and prescription discount cards

Understand how discount cards work, get advice on making smart purchases and avoiding scams, and learn about OAG services.

View publication

Indoor tanning

Know the facts. Don't fall for myths and misconceptions. Keep yourself safe.

View publication

Behavioral health parity laws

Insurance companies must cover treatment for behavioral health as they do for physical health. Learn your rights.

View publication

Mold in your home

Learn how to remove mold from your home after storms and flooding.

View publication

Reproductive health care services

State and federal laws protect both those who provide and those who obtain reproductive health care services in New York.

View publication

Urgent care centers

Understand how urgent care centers can fit into your various health care options.

View publication

Victims of domestic violence

New York laws protect victims of domestic violence, particularly in housing and employment.

View publication

Housing

Co-op boards of directors

Read about leases and other documents, and rules and powers of cooperatives' boards. Get tips for tackling problems.

View publication

Deed theft

Understand how to avoid deed theft and similar scams and keep possession of your home.

View publication

Fair housing

Read about the laws concerning discrimination in the rental, sale, or financing of homes.

View publication

Law enforcement tenants' rights guidance

We provide guidance to law enforcement responding to complaints that tenants or guests are improperly meeting at a building or grounds.

View publication

New York State Good Cause Eviction Law

In many cases, your landlord cannot convict you without a good reason. Learn how the Good Cause Eviction Law protects you.

View publication

Immigrant tenant rights

Immigrant tenants have rights in New York. We provide resources for more information and guidance.

View publication

Tenants' rights

Understand leases, rent, livability requirements, safety issues, utility services, and personal protections (does not include cooperative or condominium issues).

View publication

Tenant harassment — New York City

Here are tips on what you can do as a tenant to protect yourself from harassment by your landlord.

View publication

Tenant harassment — outside New York City

Here are tips on what you can do as a tenant to protect yourself from harassment by your landlord.

View publication

Guidance for law enforcement on unlawful eviction

We provide guidance to law enforcement responding to complaints about tenants or other occupants being illegally evicted from dwellings

View publication

Seniors

Advance directives

Learn about end-of-life health care, including advance directives, pain management, hospice care, and organ donation.

View publication

Grandparent scheme

Many scammers target grandparents. Protect yourself from fraudulent schemes.

View publication

Smart seniors, smart investors

Get tips for older adults about making smart investments and avoiding investment fraud.

View publication

Smart seniors

Understand how to protect yourself against scams, threats to your health, and elder abuse.

View publication

Students

Paying for college

Raise your financial IQ: Get tips for understanding and financing college expenses.

View publication

Students, credit cards, and banking

Raise your financial IQ: Learn about applying for and using credit cards and banking services.

View publication

Technology

Consumer guide to web tracking

Manage how businesses monitor you online to protect your privacy.

View publication

Identity theft kit

Here are immediate steps to take if your identity or other personal information has been stolen.

View publication

Protect your identity

Understand what identity theft is and how it works. Get tips for protecting your privacy and keeping your credit safe.

View publication

Workers

Equal pay

Learn your rights and get helpful resources to ensure that you are paid fairly and equitably.

View publication

Employees' rights

The law protects all workers' rights in New York. Understand your rights and learn where to find help.

View publication

Employment discrimination

Learn about laws concerning workplace discrimination and what you can do if you face it.

View publication

Religious rights in the workplace

Understand the rights and responsibilities of workers and employers in accommodating religious needs.

View publication

Sexual harassment in the workplace

Learn what sexual harassment is and the steps a victim can take. Retaliation for a sexual-harassment complaint is illegal.

View publication

Request print publications

Printed publications are available for free in English, in addition to Arabic, Bengali, Chinese, French, Haitian Creole, Italian, Korean, Polish, Russian, Spanish, Urdu, and Yiddish. You can request multiple copies or large-print format.